Question: 5. (12 points) Consider the following options written on single stocks (assume stocks pay no dividends). Clearly explain your answer for each (answers with no

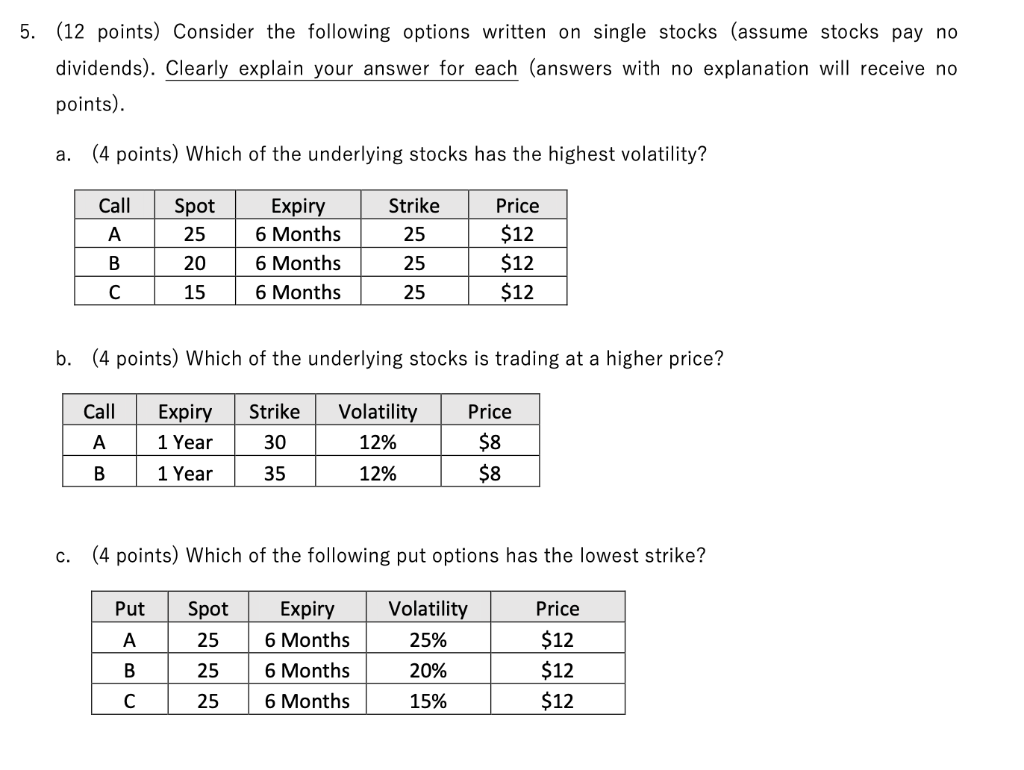

5. (12 points) Consider the following options written on single stocks (assume stocks pay no dividends). Clearly explain your answer for each (answers with no explanation will receive no points) a. (4 points) Which of the underlying stocks has the highest volatility? Call Spot 25 A Expiry 6 Months 6 Months 6 Months Strike 25 25 25 Price $12 $12 $12 B 20 C 15 b. (4 points) Which of the underlying stocks is trading at a higher price? Call Strike Expiry 1 Year 1 Year Volatility 12% A 30 Price $8 $8 B 35 12% C. (4 points) Which of the following put options has the lowest strike? Put A Spot 25 25 25 Expiry 6 Months 6 Months 6 Months Volatility 25% 20% 15% Price $12 $12 $12 B 5. (12 points) Consider the following options written on single stocks (assume stocks pay no dividends). Clearly explain your answer for each (answers with no explanation will receive no points) a. (4 points) Which of the underlying stocks has the highest volatility? Call Spot 25 A Expiry 6 Months 6 Months 6 Months Strike 25 25 25 Price $12 $12 $12 B 20 C 15 b. (4 points) Which of the underlying stocks is trading at a higher price? Call Strike Expiry 1 Year 1 Year Volatility 12% A 30 Price $8 $8 B 35 12% C. (4 points) Which of the following put options has the lowest strike? Put A Spot 25 25 25 Expiry 6 Months 6 Months 6 Months Volatility 25% 20% 15% Price $12 $12 $12 B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts