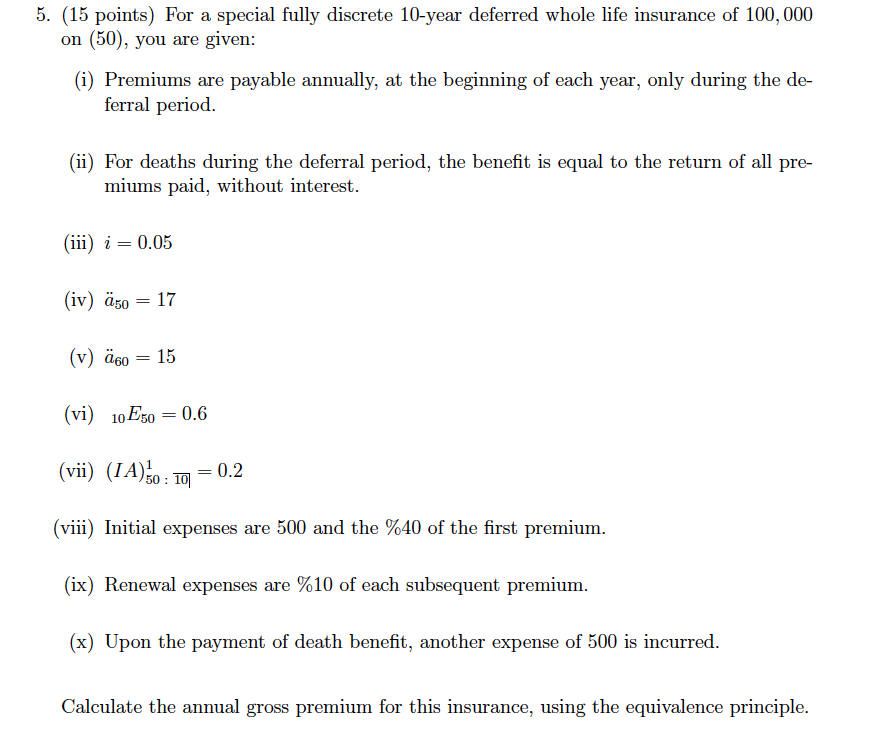

Question: 5. (15 points) For a special fully discrete 10-year deferred whole life insurance of 100,000 on (50), you are given: (i) Premiums are payable annually,

5. (15 points) For a special fully discrete 10-year deferred whole life insurance of 100,000 on (50), you are given: (i) Premiums are payable annually, at the beginning of each year, only during the de- ferral period. (ii) For deaths during the deferral period, the benefit is equal to the return of all pre- miums paid, without interest. (iii) i = 0.05 (iv) so = 17 = (v) 260 = 15 (vi) 10E50 = 0.6 (vii) (IA)50 : 10) 0.2 : (viii) Initial expenses are 500 and the %40 of the first premium. (ix) Renewal expenses are %10 of each subsequent premium. (x) Upon the payment of death benefit, another expense of 500 is incurred. Calculate the annual gross premium for this insurance, using the equivalence principle. 5. (15 points) For a special fully discrete 10-year deferred whole life insurance of 100,000 on (50), you are given: (i) Premiums are payable annually, at the beginning of each year, only during the de- ferral period. (ii) For deaths during the deferral period, the benefit is equal to the return of all pre- miums paid, without interest. (iii) i = 0.05 (iv) so = 17 = (v) 260 = 15 (vi) 10E50 = 0.6 (vii) (IA)50 : 10) 0.2 : (viii) Initial expenses are 500 and the %40 of the first premium. (ix) Renewal expenses are %10 of each subsequent premium. (x) Upon the payment of death benefit, another expense of 500 is incurred. Calculate the annual gross premium for this insurance, using the equivalence principle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts