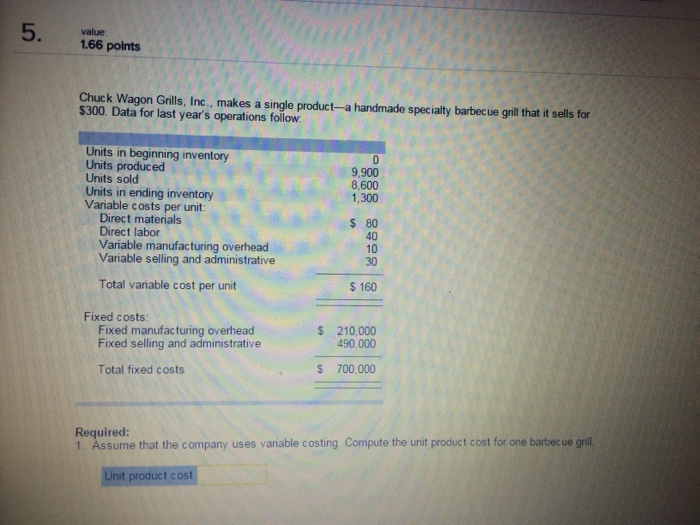

Question: 5 166 value 166 points Chuck Wagon Grills, Inc., makes a single product-a handmade specialty barbecue grill that it sells for $300. Data for last

5 166 value 166 points Chuck Wagon Grills, Inc., makes a single product-a handmade specialty barbecue grill that it sells for $300. Data for last year's operations follow Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: 9,900 8,600 1,300 Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative $ 80 40 10 30 Total variable cost per unit $ 160 Fixed costs: Fixed manufacturing overhead Fixed selling and administrative $ 210,000 490,000 Total fixed costs $ 700,000 Required: 1. Assume that the company uses variable costing Compute the unit product cost for one barbecue gnill Unit product cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts