Question: 5 2 a . Bailey recognizes a dividend of $ 1 0 0 , 0 0 0 subject to the 1 5 % tax rate

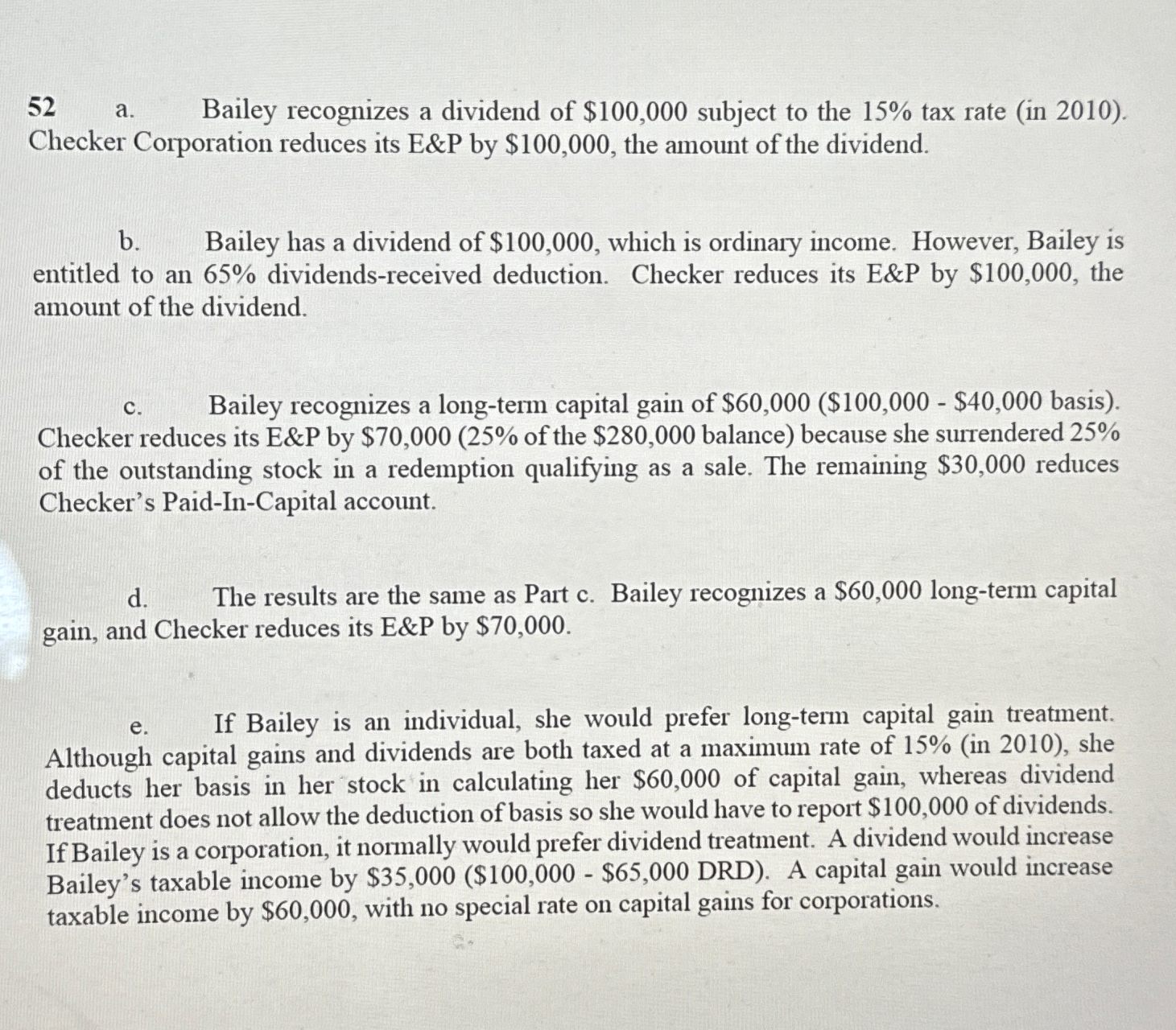

a Bailey recognizes a dividend of $ subject to the tax rate in Checker Corporation reduces its & by $ the amount of the dividend.

b Bailey has a dividend of $ which is ordinary income. However, Bailey is entitled to an dividendsreceived deduction. Checker reduces its E&P by $ the amount of the dividend.

c Bailey recognizes a longterm capital gain of $ $ $ basis Checker reduces its E&P by $ of the $ balance because she surrendered of the outstanding stock in a redemption qualifying as a sale. The remaining $ reduces Checker's PaidInCapital account.

d The results are the same as Part c Bailey recognizes a $ longterm capital gain, and Checker reduces its E&P by $

e If Bailey is an individual, she would prefer longterm capital gain treatment. Although capital gains and dividends are both taxed at a maximum rate of in she deducts her basis in her stock in calculating her $ of capital gain, whereas dividend treatment does not allow the deduction of basis so she would have to report $ of dividends. If Bailey is a corporation, it normally would prefer dividend treatment. A dividend would increase Bailey's taxable income by $ $ $ DRD A capital gain would increase taxable income by $ with no special rate on capital gains for corporations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock