Question: 5. (20 points) In this problem we adopt the continuous compounding convention. A pen- sion fund has just paid some of its liabilities, and as

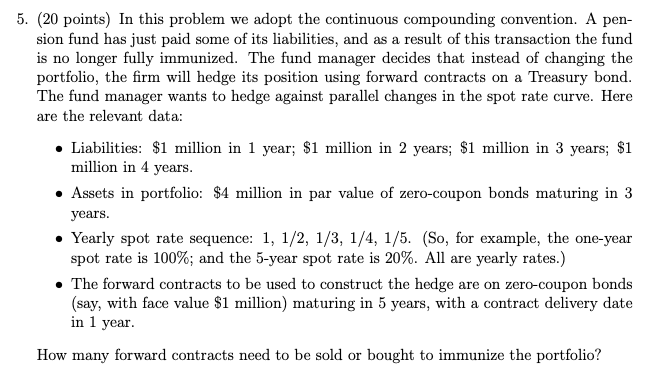

5. (20 points) In this problem we adopt the continuous compounding convention. A pen- sion fund has just paid some of its liabilities, and as a result of this transaction the fund is no longer fully immunized. The fund manager decides that instead of changing the portfolio, the firm will hedge its position using forward contracts on a Treasury bond. The fund manager wants to hedge against parallel changes in the spot rate curve. Here are the relevant data: Liabilities: $1 million in 1 year; $1 million in 2 years; $1 million in 3 years; $1 million in 4 years. Assets in portfolio: $4 million in par value of zero-coupon bonds maturing in 3 years. Yearly spot rate sequence: 1, 1/2, 1/3, 1/4, 1/5. (So, for example, the one-year spot rate is 100%; and the 5-year spot rate is 20%. All are yearly rates.) The forward contracts to be used to construct the hedge are on zero-coupon bonds (say, with face value $1 million) maturing in 5 years, with a contract delivery date in 1 year. How many forward contracts need to be sold or bought to immunize the portfolio? 5. (20 points) In this problem we adopt the continuous compounding convention. A pen- sion fund has just paid some of its liabilities, and as a result of this transaction the fund is no longer fully immunized. The fund manager decides that instead of changing the portfolio, the firm will hedge its position using forward contracts on a Treasury bond. The fund manager wants to hedge against parallel changes in the spot rate curve. Here are the relevant data: Liabilities: $1 million in 1 year; $1 million in 2 years; $1 million in 3 years; $1 million in 4 years. Assets in portfolio: $4 million in par value of zero-coupon bonds maturing in 3 years. Yearly spot rate sequence: 1, 1/2, 1/3, 1/4, 1/5. (So, for example, the one-year spot rate is 100%; and the 5-year spot rate is 20%. All are yearly rates.) The forward contracts to be used to construct the hedge are on zero-coupon bonds (say, with face value $1 million) maturing in 5 years, with a contract delivery date in 1 year. How many forward contracts need to be sold or bought to immunize the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts