Question: 5. (3 points) Using our discussion from the Eaton case, if you think the interest rates on long-term U.S. Treasury bonds partially reflect a risk

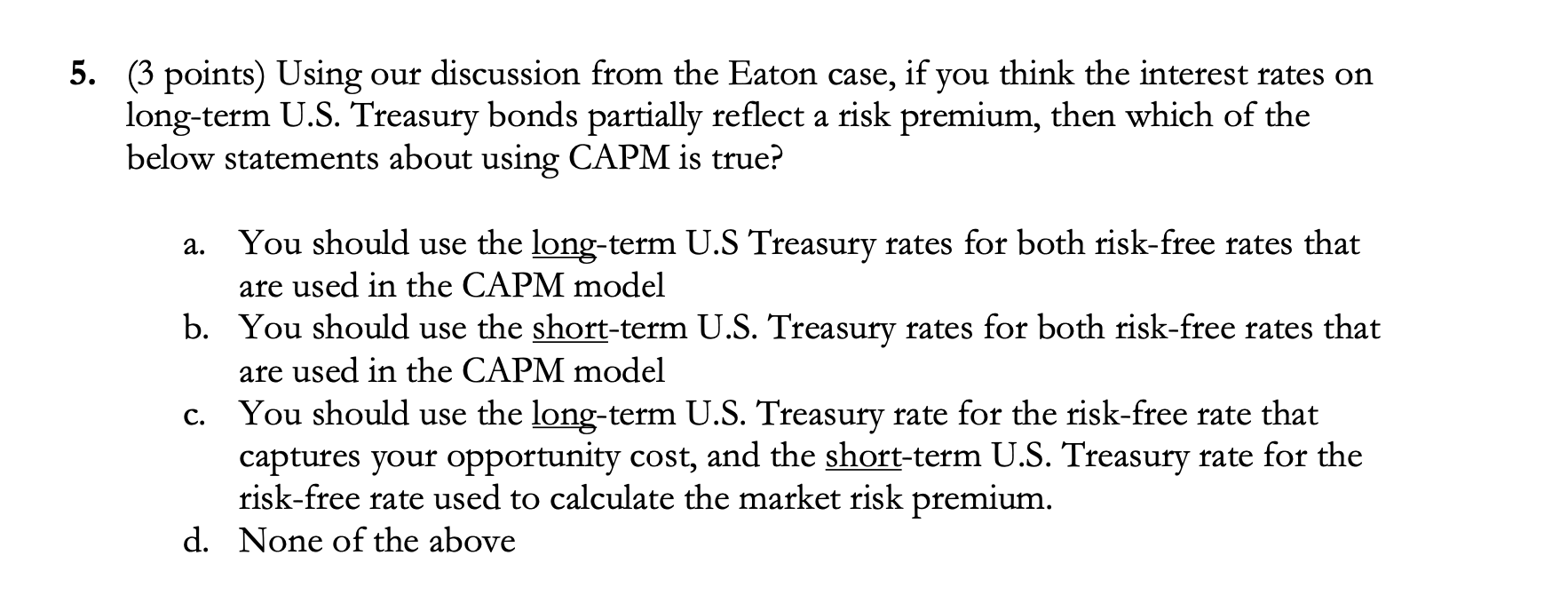

5. (3 points) Using our discussion from the Eaton case, if you think the interest rates on long-term U.S. Treasury bonds partially reflect a risk premium, then which of the below statements about using CAPM is true? a. You should use the long-term U.S Treasury rates for both risk-free rates that are used in the CAPM model b. You should use the short-term U.S. Treasury rates for both risk-free rates that are used in the CAPM model You should use the long-term U.S. Treasury rate for the risk-free rate that captures your opportunity cost, and the short-term U.S. Treasury rate for the risk-free rate used to calculate the market risk premium. d. None of the above C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts