Question: 5. (3 points) You may use the formulas or a financial calculator if you want: Show all your entries with the calculator or all of

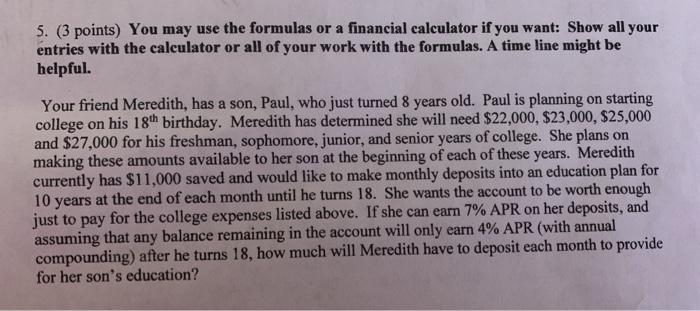

5. (3 points) You may use the formulas or a financial calculator if you want: Show all your entries with the calculator or all of your work with the formulas. A time line might be helpful. Your friend Meredith, has a son, Paul, who just turned 8 years old. Paul is planning on starting college on his 18th birthday. Meredith has determined she will need $22,000, $23,000, $25,000 and $27,000 for his freshman, sophomore, junior, and senior years of college. She plans on making these amounts available to her son at the beginning of each of these years. Meredith currently has $11,000 saved and would like to make monthly deposits into an education plan for 10 years at the end of each month until he turns 18. She wants the account to be worth enough just to pay for the college expenses listed above. If she can earn 7% APR on her deposits, and assuming that any balance remaining in the account will only earn 4% APR (with annual compounding) after he turns 18, how much will Meredith have to deposit each month to provide for her son's education

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts