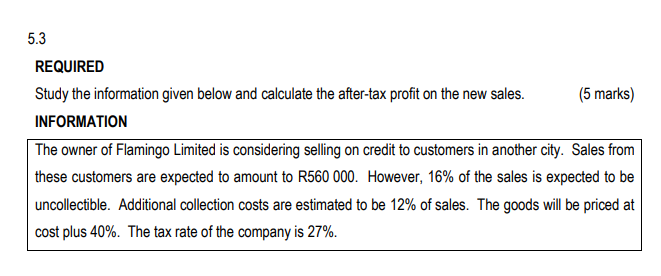

Question: 5 . 3 REQUIRED Study the information given below and calculate the after - tax profit on the new sales. ( 5 marks ) INFORMATION

REQUIRED Study the information given below and calculate the aftertax profit on the new sales. marks INFORMATION The owner of Flamingo Limited is considering selling on credit to customers in another city. Sales from these customers are expected to amount to R However, of the sales is expected to be uncollectible. Additional collection costs are estimated to be of sales. The goods will be priced at cost plus The tax rate of the company is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock