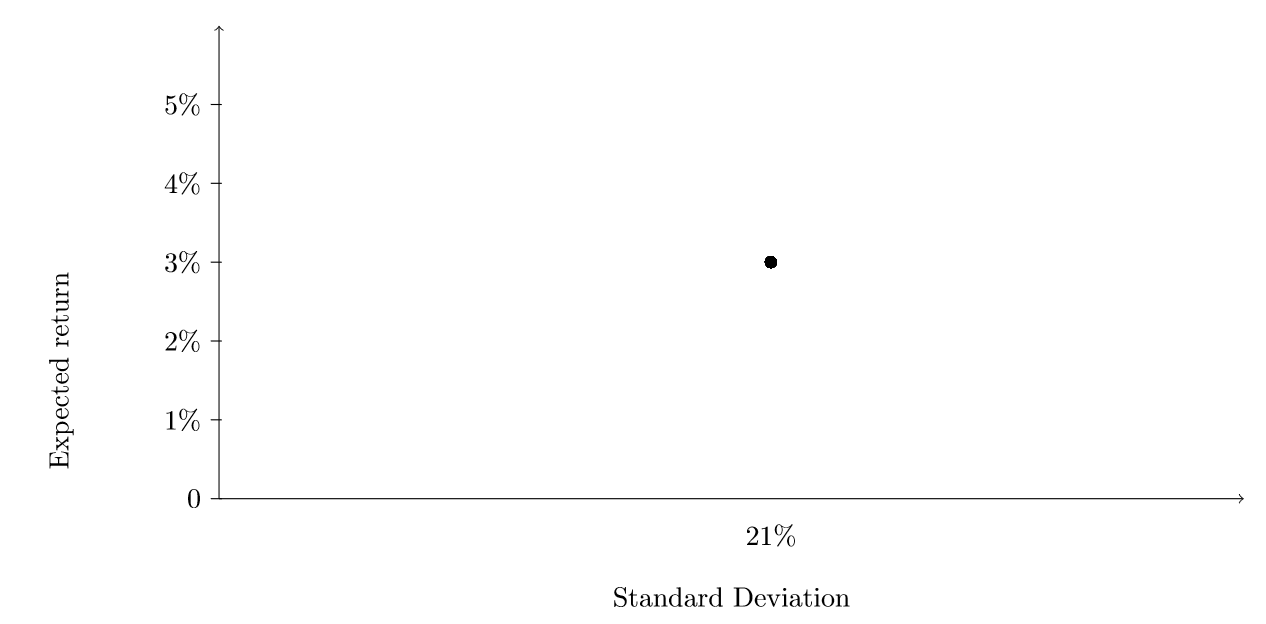

Question: 5% 4% 3% 2% Expected return 1% 0 21% Standard Deviation QUESTION 12 As in Question 11: Given the standard deviation and return of portfolio

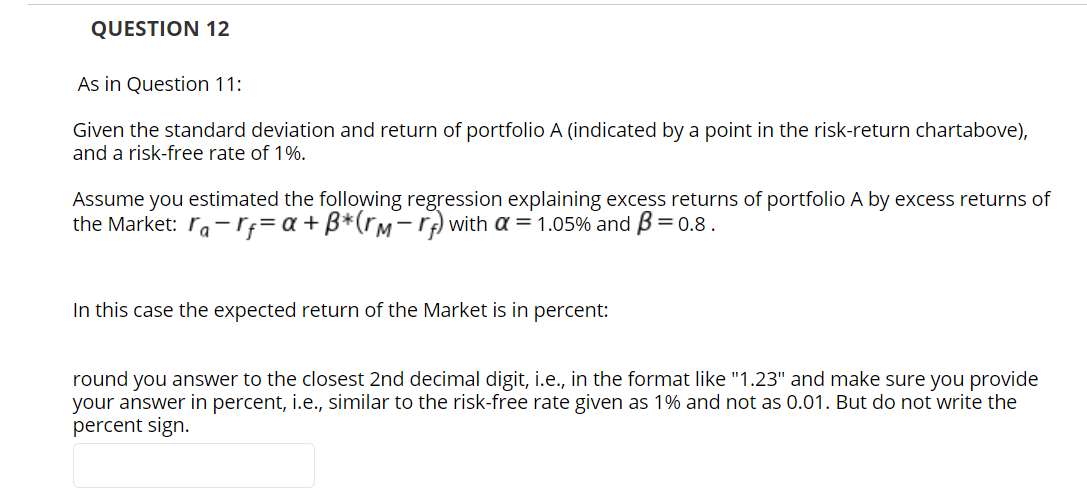

5% 4% 3% 2% Expected return 1% 0 21% Standard Deviation QUESTION 12 As in Question 11: Given the standard deviation and return of portfolio A (indicated by a point in the risk-return chartabove), and a risk-free rate of 1%. Assume you estimated the following regression explaining excess returns of portfolio A by excess returns of the Market: ra-ry=a +B*(rm-ry) with a = 1.05% and B =0.8. In this case the expected return of the Market is in percent: round you answer to the closest 2nd decimal digit, i.e., in the format like "1.23" and make sure you provide your answer in percent, i.e., similar to the risk-free rate given as 1% and not as 0.01. But do not write the percent sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts