Question: 5. (4 points) Dividend Allocation Durden Co. has $10 par value, 12% cumulative preferred stock. There are 10,000 shares issued and outstanding of the preferred

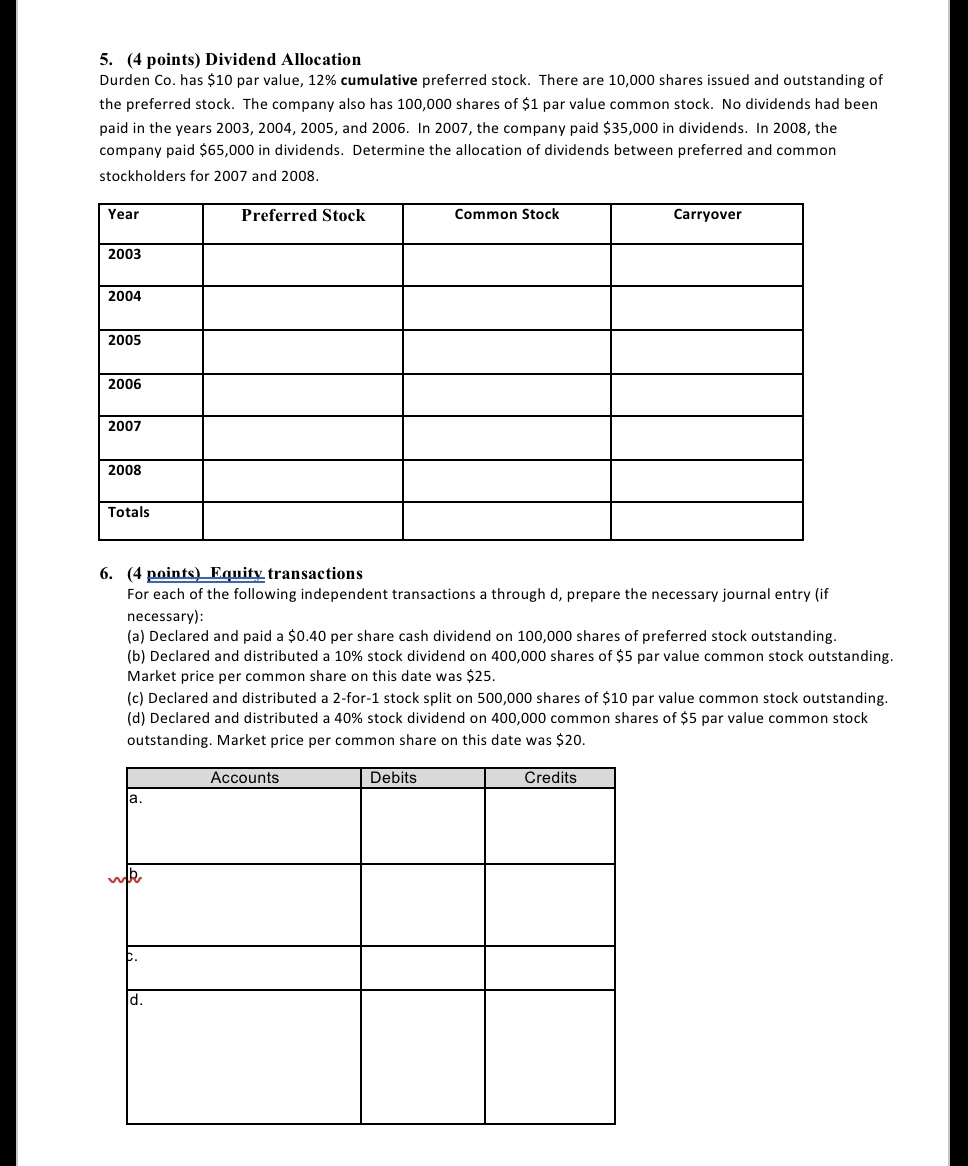

5. (4 points) Dividend Allocation Durden Co. has $10 par value, 12% cumulative preferred stock. There are 10,000 shares issued and outstanding of the preferred stock. The company also has 100,000 shares of $1 par value common stock. No dividends had been paid in the years 2003,2004,2005, and 2006 . In 2007 , the company paid $35,000 in dividends. In 2008 , the company paid $65,000 in dividends. Determine the allocation of dividends between preferred and common stockholders for 2007 and 2008. 6. (4 noints) Equity transactions For each of the following independent transactions a through d, prepare the necessary journal entry (if necessary): (a) Declared and paid a $0.40 per share cash dividend on 100,000 shares of prefered stock outstanding. (b) Declared and distributed a 10% stock dividend on 400,000 shares of $5 par value common stock outstanding. Market price per common share on this date was $25. (c) Declared and distributed a 2 -for-1 stock split on 500,000 shares of $10 par value common stock outstanding. (d) Declared and distributed a 40% stock dividend on 400,000 common shares of $5 par value common stock outstanding. Market price per common share on this date was $20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts