Question: 5. (40 pts) There are three risky assets with (random) rates of return t'], ['2, and 13, respectively. Shorting is allowed in this market. The

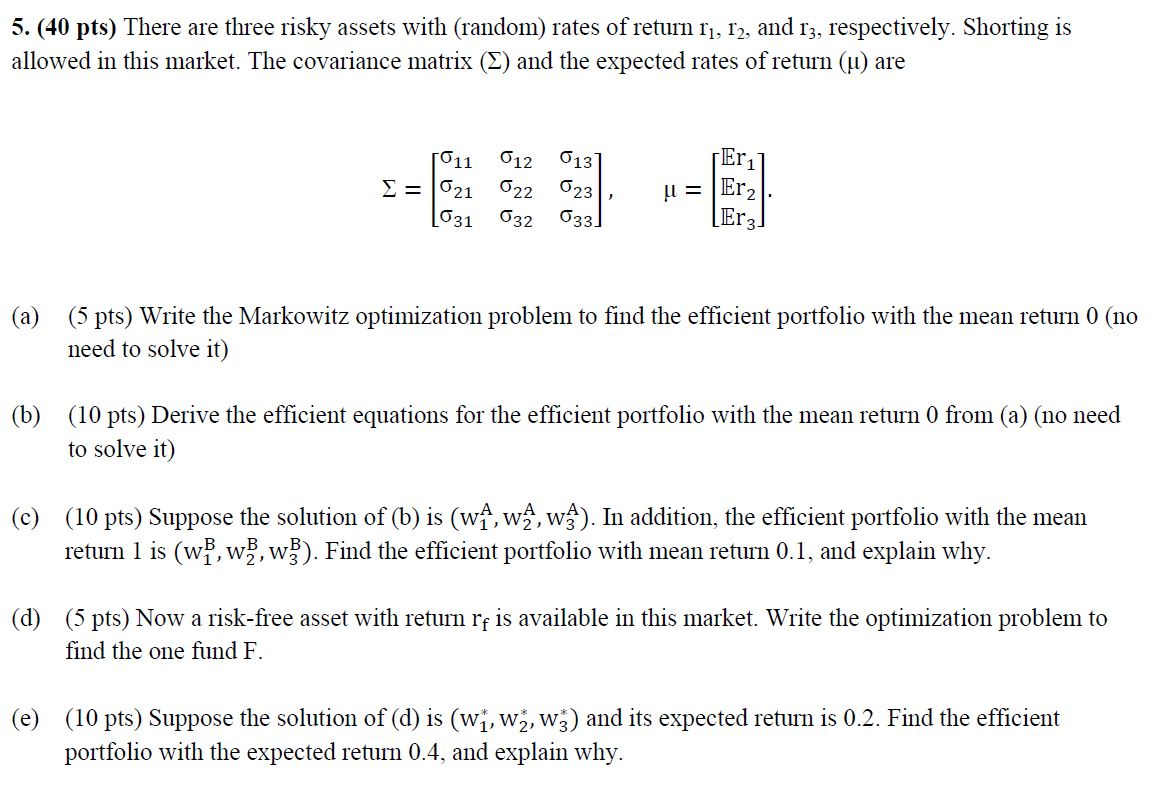

5. (40 pts) There are three risky assets with (random) rates of return t'], ['2, and 13, respectively. Shorting is allowed in this market. The covariance matrix (2) and the expected rates of return (u) are 1011 012 013] = 1021 022 023 [031 032 033) Eril Er21 u = [Erz] (a) (5 pts) Write the Markowitz optimization problem to find the efficient portfolio with the mean return 0 (no need to solve it) (b) (10 pts) Derive the efficient equations for the efficient portfolio with the mean return 0 from (a) (no need to solve it) (c) (10 pts) Suppose the solution of (b) is (WA, WA, WA). In addition, the efficient portfolio with the mean return 1 is (w, w, w}). Find the efficient portfolio with mean return 0.1, and explain why. (d) (5 pts) Now a risk-free asset with return rf is available in this market. Write the optimization problem to find the one fund F. (e) (10 pts) Suppose the solution of (d) is (wi, w, w) and its expected return is 0.2. Find the efficient portfolio with the expected return 0.4, and explain why. 5. (40 pts) There are three risky assets with (random) rates of return t'], ['2, and 13, respectively. Shorting is allowed in this market. The covariance matrix (2) and the expected rates of return (u) are 1011 012 013] = 1021 022 023 [031 032 033) Eril Er21 u = [Erz] (a) (5 pts) Write the Markowitz optimization problem to find the efficient portfolio with the mean return 0 (no need to solve it) (b) (10 pts) Derive the efficient equations for the efficient portfolio with the mean return 0 from (a) (no need to solve it) (c) (10 pts) Suppose the solution of (b) is (WA, WA, WA). In addition, the efficient portfolio with the mean return 1 is (w, w, w}). Find the efficient portfolio with mean return 0.1, and explain why. (d) (5 pts) Now a risk-free asset with return rf is available in this market. Write the optimization problem to find the one fund F. (e) (10 pts) Suppose the solution of (d) is (wi, w, w) and its expected return is 0.2. Find the efficient portfolio with the expected return 0.4, and explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts