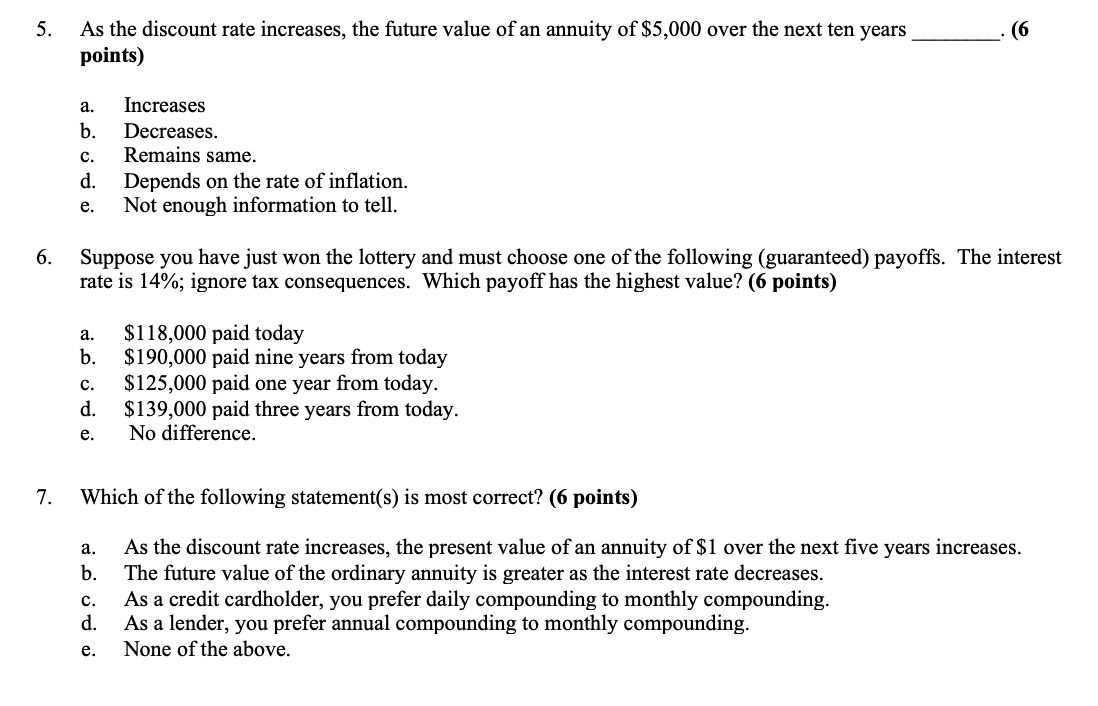

Question: 5. (6 As the discount rate increases, the future value of an annuity of $5,000 over the next ten years points) a. b. c. d.

5. (6 As the discount rate increases, the future value of an annuity of $5,000 over the next ten years points) a. b. c. d. Increases Decreases. Remains same. Depends on the rate of inflation. Not enough information to tell. e. 6. Suppose you have just won the lottery and must choose one of the following (guaranteed) payoffs. The interest rate is 14%; ignore tax consequences. Which payoff has the highest value? (6 points) a. b. c. d. $118,000 paid today $190,000 paid nine years from today $125,000 paid one year from today. $139,000 paid three years from today. No difference. e. 7. Which of the following statement(s) is most correct? (6 points) a. b. Govo c d As the discount rate increases, the present value of an annuity of $1 over the next five years increases. The future value of the ordinary annuity is greater as the interest rate decreases. As a credit cardholder, you prefer daily compounding to monthly compounding. As a lender, you prefer annual compounding to monthly compounding. None of the above. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts