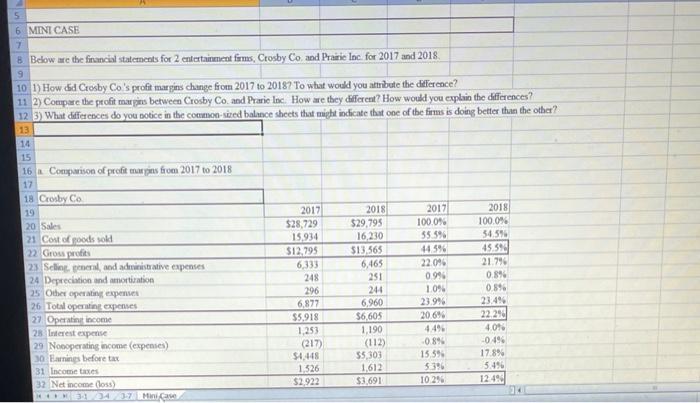

Question: 5 6 MINI CASE 7 8. Below are the financial statements for 2 entertainment firms, Crosby Co and Prairie Inc. for 2017 and 2018 9

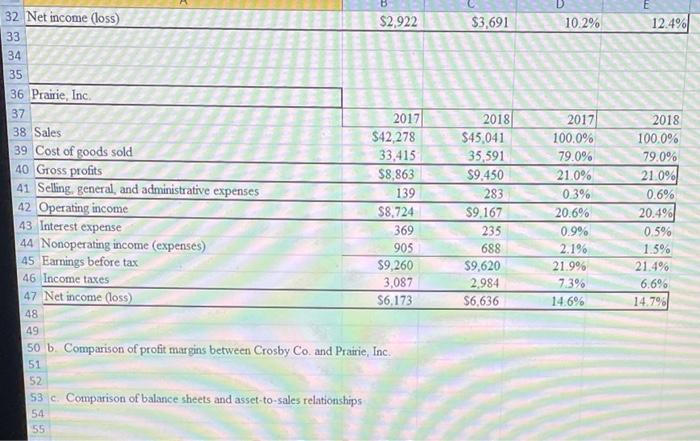

5 6 MINI CASE 7 8. Below are the financial statements for 2 entertainment firms, Crosby Co and Prairie Inc. for 2017 and 2018 9 10 1) How did Crosby Co's profit margins change from 2017 to 2018? To what would you attribute the difference? 11 2) Compare the profit marines between Crosby Co and Pranie loc. How are they different? How would you explain the differences? 12 S) What differences do you notice in the common-sized balance sheets that might indicate that one of the firms is doing better than the other? 13 14 15 16 Comparison of profit marins from 2017 to 2018 17 18 Crosby Co 19 2017 2018 2017 2018 20 Sales $28,729 $29,795 100.0% 100.0% 21 Cotopoods sold 15,934 16,230 55 396 54.59 22 Gross profits $12,795 $13,565 44.596 45.594 23. Sel peneral and administrative expenses 6,333 6,465 22.046 21.796 24 Depreciation and motivation 248 251 0995 0.8% 25 Other operating expenses 296 244 10% 0.8% 26 Total operatint expenses 6,877 6.960 23.9% 23.4% 27. Operating income $5,918 $6,605 20.6% 22 290 23 Interest expense 1.253 4.09 29 Nooperating income (expenses) (217) (112) 0.8% 0496 30 Farines before tax $4,448 55.303 15.59 17.8% 31 Income taxes 1.526 1,612 5.496 32 Net income doss) $2,922 $3.691 10 296 1249 4. Mina 1,190 $3,691 10.2% 12.4% 32 Net income (loss) $2,922 33 34 35 36 Prairie, Inc 37 2017 38 Sales S42,278 39 Cost of goods sold 33,415 40 Gross profits $8,863 41 Selling, general, and administrative expenses 139 42 Operating income $8.724 43 Interest expense 369 44 Nonoperating income (expenses) 905 45 Earnings before tax $9,260 46 Income taxes 3,087 47 Net income (los) S6.173 48 49 50 b. Comparison of profit margins between Crosby Co and Prairie, Inc. 51 52 53 c. Comparison of balance sheets and asset to-sales relationships 54 55 2018 $45,041 35,591 $9.450 283 $9.167 235 688 $9,620 2,984 $6,636 2017 100.0% 79.0% 21.0% 0.3% 20.6% 0.9% 2.1% 21.9% 7.3% 14.6% 2018 100.0% 79.0% 21.0% 0.6% 20.4% 0.5% 1.5% 21.4% 6.6% 14.79 5 6 MINI CASE 7 8. Below are the financial statements for 2 entertainment firms, Crosby Co and Prairie Inc. for 2017 and 2018 9 10 1) How did Crosby Co's profit margins change from 2017 to 2018? To what would you attribute the difference? 11 2) Compare the profit marines between Crosby Co and Pranie loc. How are they different? How would you explain the differences? 12 S) What differences do you notice in the common-sized balance sheets that might indicate that one of the firms is doing better than the other? 13 14 15 16 Comparison of profit marins from 2017 to 2018 17 18 Crosby Co 19 2017 2018 2017 2018 20 Sales $28,729 $29,795 100.0% 100.0% 21 Cotopoods sold 15,934 16,230 55 396 54.59 22 Gross profits $12,795 $13,565 44.596 45.594 23. Sel peneral and administrative expenses 6,333 6,465 22.046 21.796 24 Depreciation and motivation 248 251 0995 0.8% 25 Other operating expenses 296 244 10% 0.8% 26 Total operatint expenses 6,877 6.960 23.9% 23.4% 27. Operating income $5,918 $6,605 20.6% 22 290 23 Interest expense 1.253 4.09 29 Nooperating income (expenses) (217) (112) 0.8% 0496 30 Farines before tax $4,448 55.303 15.59 17.8% 31 Income taxes 1.526 1,612 5.496 32 Net income doss) $2,922 $3.691 10 296 1249 4. Mina 1,190 $3,691 10.2% 12.4% 32 Net income (loss) $2,922 33 34 35 36 Prairie, Inc 37 2017 38 Sales S42,278 39 Cost of goods sold 33,415 40 Gross profits $8,863 41 Selling, general, and administrative expenses 139 42 Operating income $8.724 43 Interest expense 369 44 Nonoperating income (expenses) 905 45 Earnings before tax $9,260 46 Income taxes 3,087 47 Net income (los) S6.173 48 49 50 b. Comparison of profit margins between Crosby Co and Prairie, Inc. 51 52 53 c. Comparison of balance sheets and asset to-sales relationships 54 55 2018 $45,041 35,591 $9.450 283 $9.167 235 688 $9,620 2,984 $6,636 2017 100.0% 79.0% 21.0% 0.3% 20.6% 0.9% 2.1% 21.9% 7.3% 14.6% 2018 100.0% 79.0% 21.0% 0.6% 20.4% 0.5% 1.5% 21.4% 6.6% 14.79

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts