Question: 5. 6. Oriole Co. is considering purchasing a new machine that will cost $210700, but which will decrease costs each year by $49000. The useful

5.

6.

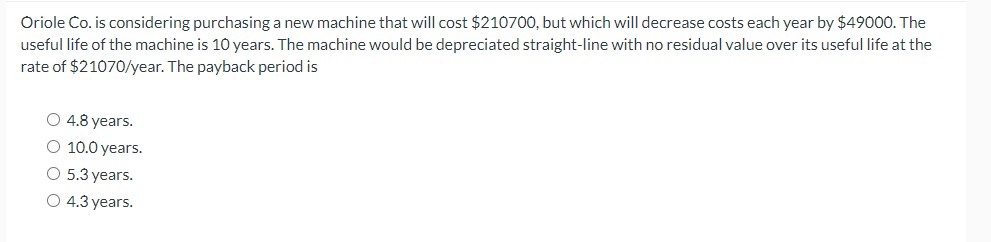

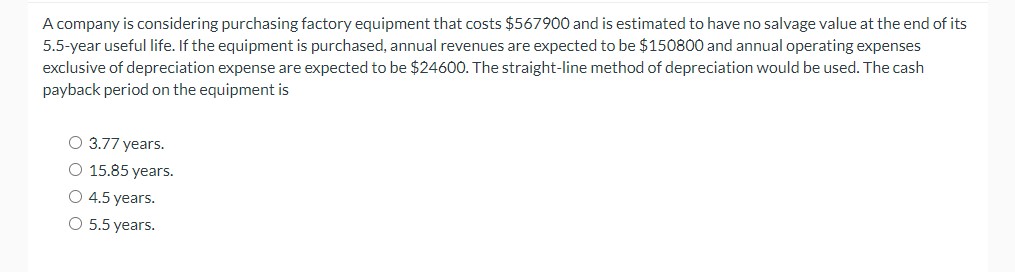

Oriole Co. is considering purchasing a new machine that will cost $210700, but which will decrease costs each year by $49000. The useful life of the machine is 10 years. The machine would be depreciated straight-line with no residual value over its useful life at the rate of $21070/ year. The payback period is 4.8 years. 10.0 years. 5.3 years. 4.3 years. A company is considering purchasing factory equipment that costs $567900 and is estimated to have no salvage value at the end of its 5.5-year useful life. If the equipment is purchased, annual revenues are expected to be $150800 and annual operating expenses exclusive of depreciation expense are expected to be $24600. The straight-line method of depreciation would be used. The cash payback period on the equipment is 3.77 years. 15.85 years. 4.5 years. 5.5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts