Question: 5 7 8 Chapter 1 5 1 5 . 9 The folowing draft statements of financial position relate to McHill. McTall and McZon, all public

Chapter

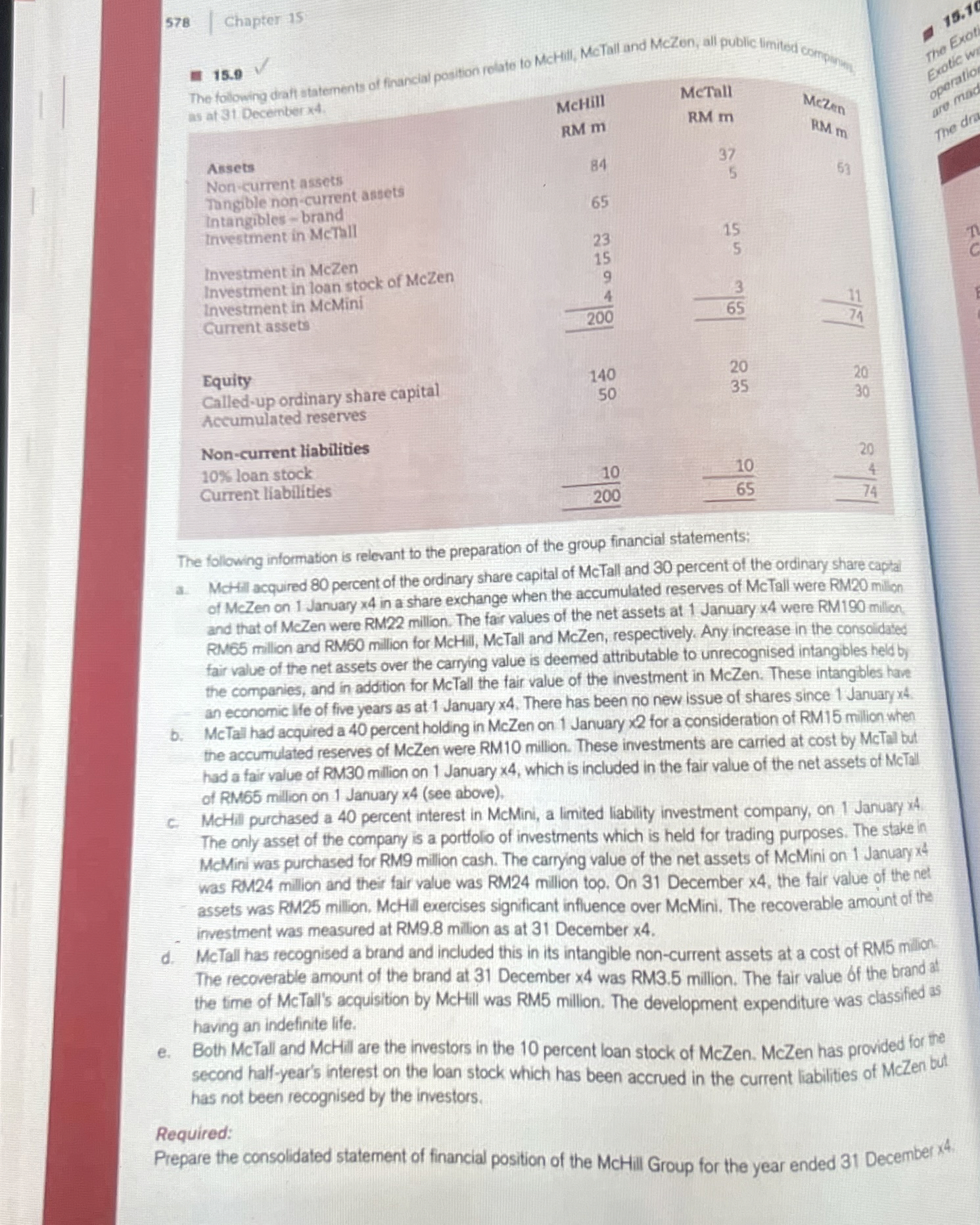

The folowing draft statements of financial position relate to McHill. McTall and McZon, all public limited compergiof as at December

The following information is relevant to the preparation of the group financial statements:

a McHill acquired percent of the ordinary share capital of McTall and percent of the ordinary share captal of McZen on January in a share exchange when the accumulated reserves of McTall were RM milion and that of McZen were RM million. The fair values of the net assets at January were RM milion RM million and RM million for McHill, McTall and McZen, respectively. Any increase in the conscidated fair value of the net assets over the carrying value is deemed attributable to unrecognised intangibles held by the companies, and in addition for McTall the fair value of the investment in McZen. These intangibles have an economic ife of five years as at January There has been no new issue of shares since Januaryx

b McTall had acquired a percent holding in McZen on January for a consideration of RM million when the accumulated reserves of McZen were RM million. These investments are carried at cost by McTal but had a fair value of RM million on January which is included in the fair value of the net assets of McTall of RM milion on January see above

c McHill purchased a percent interest in McMini, a limited liability investment company, on January x The only asset of the company is a portfolo of investments which is held for trading purposes. The stake in McMini was purchased for RM million cash. The carrying value of the net assets of McMini on January was FJM million and their fair value was RM million too. On December the fair value of the nel assets was RM million, McHill exercises significant influence over McMini. The recoverable amount of the irvestment was measured at RM milion as at December

d McTall has recognised a brand and included this in its intangible noncurrent assets at a cost of RM milion The recoverable amount of the brand at December was RM million. The fair value of the brand at the time of McTall's acquisition by McHill was RM million. The development expenditure was classified as having an indefinite life.

e Both McTall and McHill are the investors in the percent loan stock of McZen. McZen has provided for the second halfyear's interest on the loan stock which has been accrued in the current liabilities of McZen but has not been recognised by the investors.

Required:

Prepare the consolidated statement of financial position of the McHill Group for the year ended December x

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock