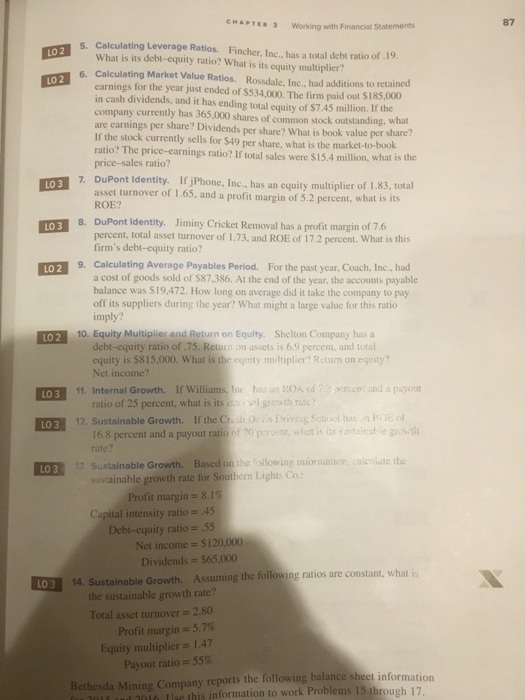

Question: #5 #7 #8 CHAPTER 3 working with Financial Statements 5. Calculating Leverage Ratios. Fincher, Inc. has a total debt ratio of 19 what is its

CHAPTER 3 working with Financial Statements 5. Calculating Leverage Ratios. Fincher, Inc. has a total debt ratio of 19 what is its debt-equity ratio? What is its equity multiplier? LO 2 6. Calculating Market value Ratios. Rossdale. Inc.. had additions to retained earnings for the year just ended of S534,000. The firm paid out S185.00 cash LO 2 in dividends, and it has ending total equity of s745 million. If the company currently has 365,000 shares of common stock outstanding. what are earnings per share? Dividends per share? What is book value per share? the stock currently sells for $49 per share, what is the market-to-book ratio? The price-earnings ratio? If total sales were s15.4 million, what is the price-sales ratio? 7. DuPont Identity. IfjPhone, Inc., has an equity multiplier of 1.83 total LO 3 asset turnover of 1.65. and a profit margin of 5.2 percent. what is its ROE? 8. DuPont identity, Jiminy Cricket Removal has a profit of percent, margin what is this total asset turnover of 1.73, and ROE of 17.2 percent. firm's debt-equity ratio? 9. Calculating Average Payables Period. For the past year, Coach. Inc., had LO 2 a cost of goods sold of $87.386. At the end of the year, the accounts payable balance was S19.472. How long on average did it take the company to pay off its suppliers during the year? What might a large value for this ratio LO2 10, Equity Multiplier and Return on Equity Shelton Company has a debt-equity ratio of 75. Ret n on assets is 6.9 percent, and total equity is $815,000. What is the equity multiplier Return on equity? Net income? ILO3 11. Internal Growth. If Williams, Inc has an ROA of percent and a payout ratio of 25 percent, what is its irto. growth rate? 12 sustainable Growth. If the Cr LO 3 6.8 percent and a payout ratio of peront, wi at is its 12 stainable Growth, Based on the following iniorniation alettiate the LO 3 stainable growth rate for Southern Lights Co Profit margin 8.1 Capital intensity ratio .45 bt-equity ratio .55 Net income S120,000 Dividends S65,000 os are constant, what 14. Sustainable Growth. Assuming the follow LO 3 the sustainable growth rate? Total asset turnover 2.80 Profit margin 5.79i Equity multiplier 1.47 55% Payout ratio Bethesda Mining Company reports the following balance sheet information information to work Problems 15 throu 17 gh

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts