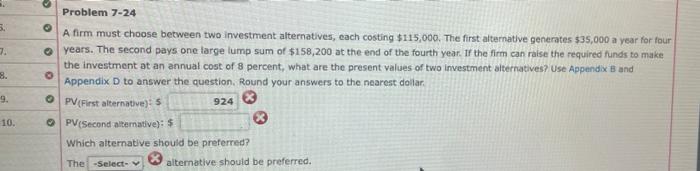

Question: 5. 7. Problem 7-24 A firm must choose between two investment alternatives, cach costing $115,000. The first alternative generates $35,000 a year for four years.

5. 7. Problem 7-24 A firm must choose between two investment alternatives, cach costing $115,000. The first alternative generates $35,000 a year for four years. The second pays one large lump sum of $158,200 at the end of the fourth year. If the firm can raise the required funds to make the investment at an annual cost of 8 percent, what are the present values of two investment alternatives? Use Appendix Band Appendix D to answer the question. Round your answers to the nearest dollar, PV (First alternative): 5 O PV(Second alternative): $ Which alternative should be preferred? * The -Select- alternative should be preferred. 9. 924 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts