Question: 5. (7 pt) Your boss is evaluating two printers for the office. Printer A costs $500, has an annual operating cost of $60, and

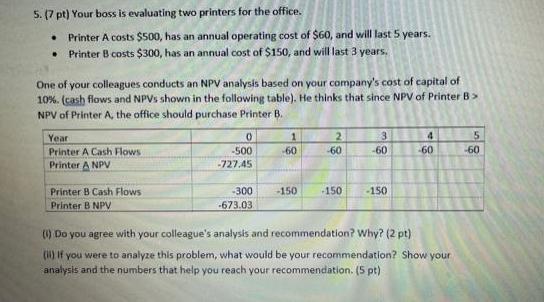

5. (7 pt) Your boss is evaluating two printers for the office. Printer A costs $500, has an annual operating cost of $60, and will last 5 years. Printer B costs $300, has an annual cost of $150, and will last 3 years. . One of your colleagues conducts an NPV analysis based on your company's cost of capital of 10%. (cash flows and NPVS shown in the following table). He thinks that since NPV of Printer B> NPV of Printer A, the office should purchase Printer B. Year Printer A Cash Flows Printer A NPV Printer B Cash Flows Printer B NPV 0 -500 -727.45 -300 -673.03. 1 -60 2 -60 3 -60 -150 -150 -150 4 -60 (1) Do you agree with your colleague's analysis and recommendation? Why? (2 pt) (ii) If you were to analyze this problem, what would be your recommendation? Show your analysis and the numbers that help you reach your recommendation. (5 pt) 5 -60

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

1 I do not agree with your colleagues analysis and recommendation solely based on the NPV values NPV ... View full answer

Get step-by-step solutions from verified subject matter experts