Question: 5. (8 marks) The following table lists the annual returns on Canadian small and emerging companies/stocks during the 16-year period from 2002 to 2017. If

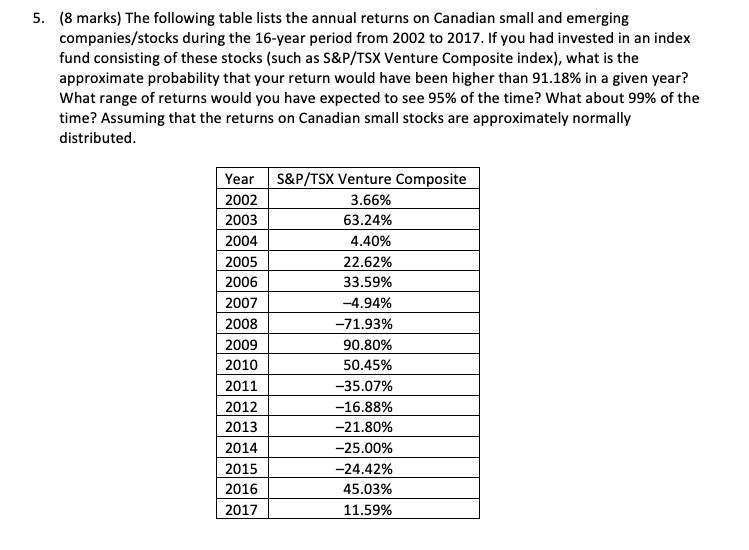

5. (8 marks) The following table lists the annual returns on Canadian small and emerging companies/stocks during the 16-year period from 2002 to 2017. If you had invested in an index fund consisting of these stocks (such as S&P/TSX Venture Composite index), what is the approximate probability that your return would have been higher than 91.18% in a given year? What range of returns would you have expected to see 95% of the time? What about 99% of the time? Assuming that the returns on Canadian small stocks are approximately normally distributed. Year S&P/TSX Venture Composite 2002 3.66% 2003 63.24% 2004 4.40% 2005 22.62% 2006 33.59% 2007 -4.94% 2008 -71.93% 2009 90.80% 2010 50.45% 2011 -35.07% 2012 -16.88% 2013 -21.80% 2014 -25.00% 2015 -24.42% 2016 45.03% 2017 11.59%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts