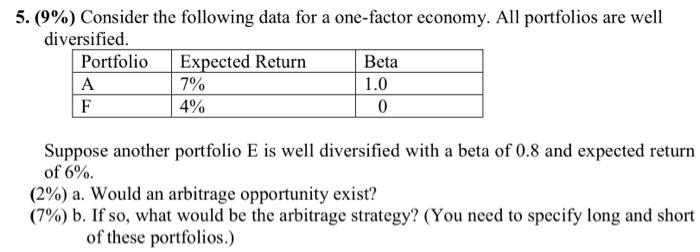

Question: 5. (9%) Consider the following data for a one-factor economy. All portfolios are well diversified. Suppose another portfolio E is well diversified with a beta

5. (9\%) Consider the following data for a one-factor economy. All portfolios are well diversified. Suppose another portfolio E is well diversified with a beta of 0.8 and expected retur of 6%. (2\%) a. Would an arbitrage opportunity exist? (7\%) b. If so, what would be the arbitrage strategy? (You need to specify long and shor of these portfolios.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock