Question: 5. (9 points) Consider the Excel/@Risk analysis on a hypothetical income producing property shown below. The only input risk distribution defined in this analysis

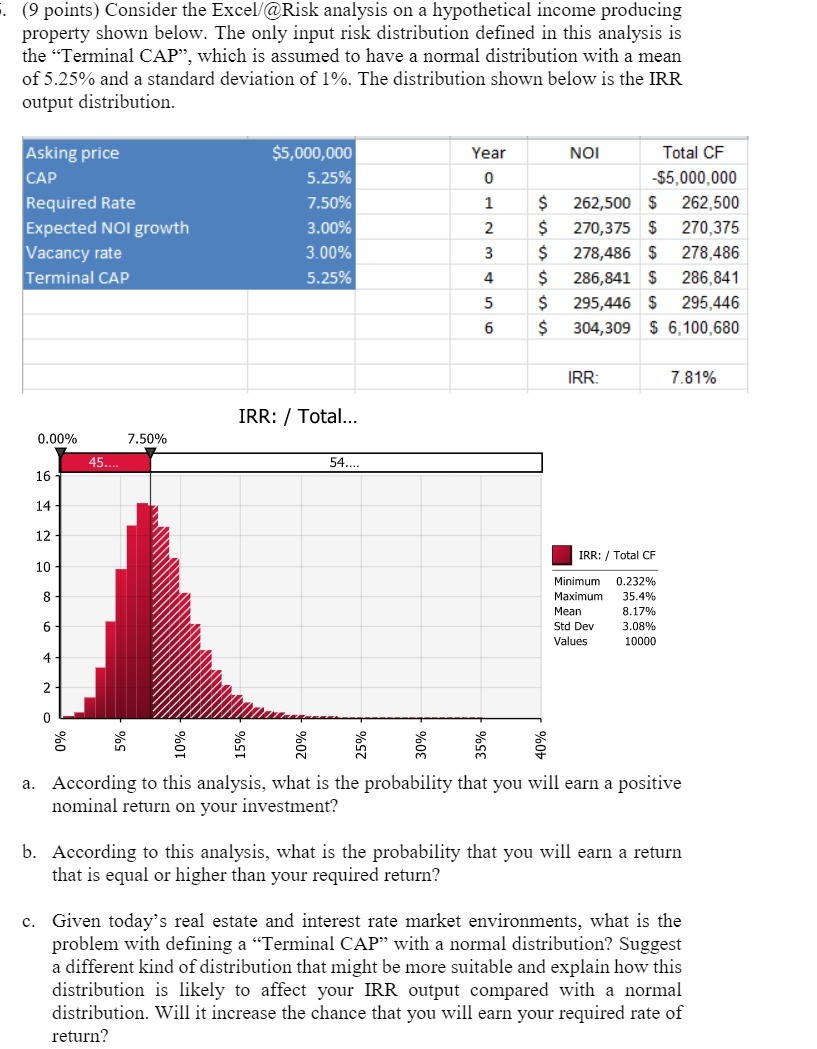

5. (9 points) Consider the Excel/@Risk analysis on a hypothetical income producing property shown below. The only input risk distribution defined in this analysis is the "Terminal CAP", which is assumed to have a normal distribution with a mean of 5.25% and a standard deviation of 1%. The distribution shown below is the IRR output distribution. Asking price $5,000,000 Year CAP 5.25% 0 Total CF -$5,000,000 Required Rate 7.50% 1 $ 262,500 $ 262,500 Expected NOI growth 3.00% 2 $ 270,375 $ 270,375 Vacancy rate 3.00% 3 $ 278,486 $ 278,486 Terminal CAP 5.25% 4 $ 286,841 $ 286,841 5 $ 295,446 $ 295,446 6 $ 304,309 $6,100,680 IRR: 7.81% 0.00% 7.50% 45.... 16 14 12 10 8 6 4 2 0 IRR: / Total... 54.... 35% IRR: Total CF Minimum 0.232% Maximum 35.4% Mean 8.17% Std Dev 3.08% Values 10000 a. According to this analysis, what is the probability that you will earn a positive nominal return on your investment? b. According to this analysis, what is the probability that you will earn a return that is equal or higher than your required return? c. Given today's real estate and interest rate market environments, what is the problem with defining a "Terminal CAP" with a normal distribution? Suggest a different kind of distribution that might be more suitable and explain how this distribution is likely to affect your IRR output compared with a normal distribution. Will it increase the chance that you will earn your required rate of return?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts