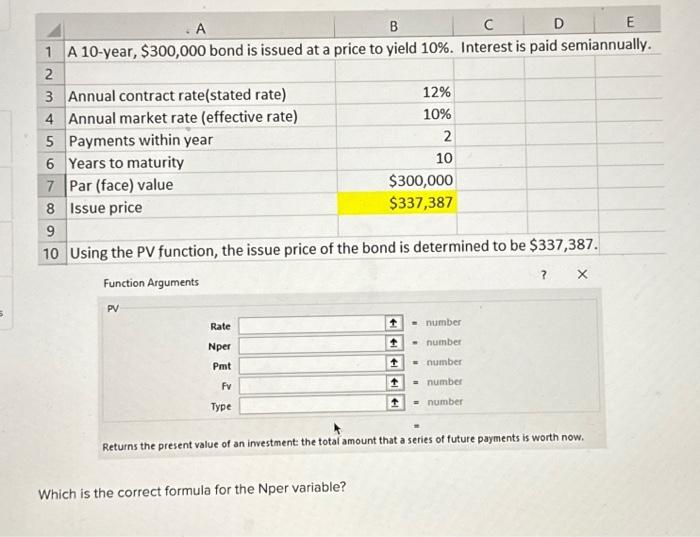

Question: 5 . A B C D 1 A 10-year, $300,000 bond is issued at a price to yield 10%. Interest is paid semiannually. 2 3

5 . A B C D 1 A 10-year, $300,000 bond is issued at a price to yield 10%. Interest is paid semiannually. 2 3 Annual contract rate(stated rate) 4 Annual market rate (effective rate) Payments within year 5 6 Years to maturity 7 Par (face) value 8 Issue price PV Rate Nper Pmt Fv Type 9 10 Using the PV function, the issue price of the bond is determined to be $337,387. Function Arguments Which is the correct formula for the Nper variable? 12% 10% $300,000 $337,387 2 10 = number = number = number = number = number ? X Returns the present value of an investment: the total amount that a series of future payments is worth now. E

Which is the correct formula for the Nper variable

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock