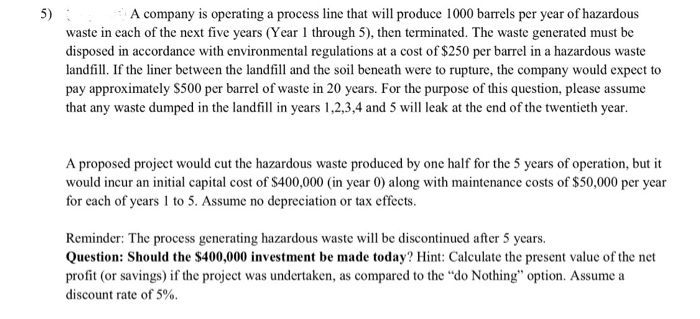

Question: 5) A company is operating a process line that will produce 1000 barrels per year of hazardous waste in each of the next five years

5) A company is operating a process line that will produce 1000 barrels per year of hazardous waste in each of the next five years (Year 1 through 5), then terminated. The waste generated must be disposed in accordance with environmental regulations at a cost of $250 per barrel in a hazardous waste landfill. If the liner between the landfill and the soil beneath were to rupture, the company would expect to pay approximately S500 per barrel of waste in 20 years. For the purpose of this question, please assume that any waste dumped in the landfill in years 1,2,3,4 and 5 will leak at the end of the twentieth year A proposed project would cut the hazardous waste produced by one half for the 5 years of operation, but it would incur an initial capital cost of $400,000 (in year 0) along with maintenance costs of $50,000 per year for each of years 1 to 5. Assume no depreciation or tax effects Reminder: The process generating hazardous waste will be discontinued after 5 years. Question: Should the $400,000 investment be made today? Hint: Calculate the present value of the net profit (or savings) if the project was undertaken, as compared to the "do Nothing" option. Assume a discount rate of 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts