Question: 5. A good reason for M&As does not include: a) Stopping a competitor merging or taking over b) Complementing business strategies c) Supporting value-added growth

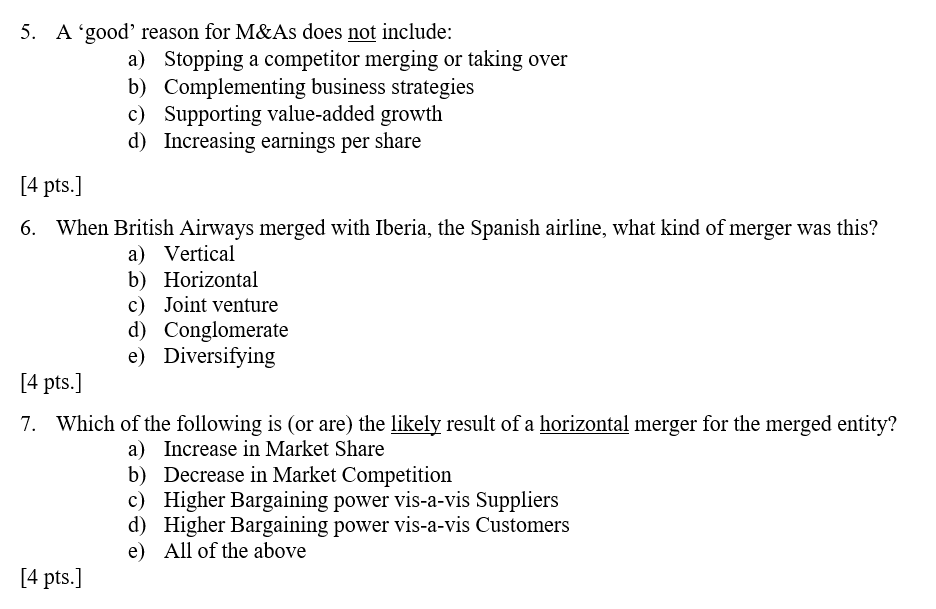

5. A good reason for M&As does not include: a) Stopping a competitor merging or taking over b) Complementing business strategies c) Supporting value-added growth d) Increasing earnings per share [4 pts.] 6. When British Airways merged with Iberia, the Spanish airline, what kind of merger was this? a) Vertical b) Horizontal c) Joint venture d) Conglomerate e) Diversifying [4 pts.] 7. Which of the following is (or are) the likely result of a horizontal merger for the merged entity? a) Increase in Market Share b) Decrease in Market Competition c) Higher Bargaining power vis-a-vis Suppliers d) Higher Bargaining power vis-a-vis Customers e) All of the above [4 pts.] 5. A good reason for M&As does not include: a) Stopping a competitor merging or taking over b) Complementing business strategies c) Supporting value-added growth d) Increasing earnings per share [4 pts.] 6. When British Airways merged with Iberia, the Spanish airline, what kind of merger was this? a) Vertical b) Horizontal c) Joint venture d) Conglomerate e) Diversifying [4 pts.] 7. Which of the following is (or are) the likely result of a horizontal merger for the merged entity? a) Increase in Market Share b) Decrease in Market Competition c) Higher Bargaining power vis-a-vis Suppliers d) Higher Bargaining power vis-a-vis Customers e) All of the above [4 pts.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts