Question: 5 A portfolio manager at United Sisters Inc. is structuring a fixed - income portfolio to meet the objectives of a US client. The portfolio

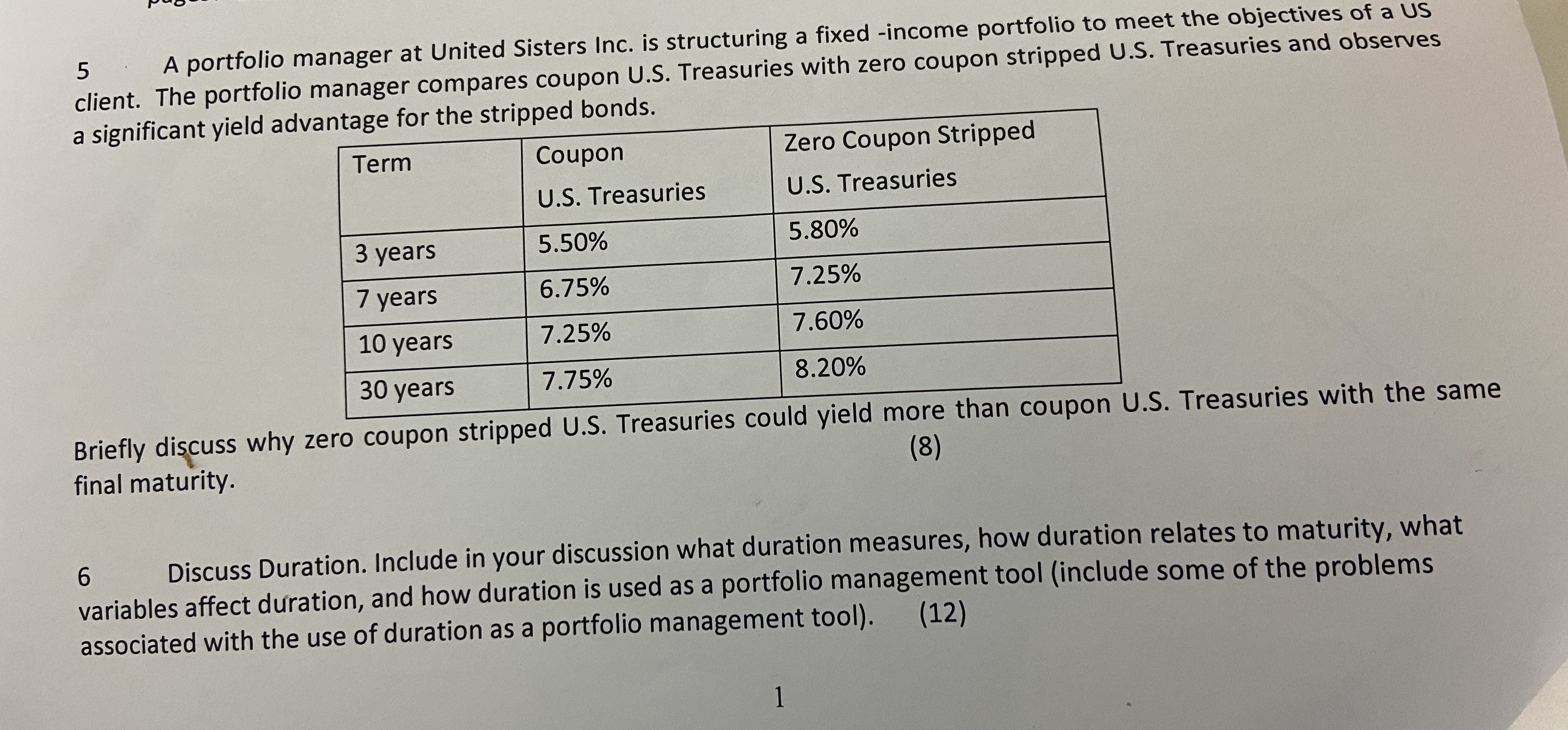

A portfolio manager at United Sisters Inc. is structuring a fixedincome portfolio to meet the objectives of a US

client. The portfolio manager compares coupon US Treasuries with zero coupon stripped US Treasuries and observes

a significant yield advantage for the stripped bonds.

Briefly discuss why zero coupon stripped US Treasuries could yield more than coupon US Treasuries with the same

final maturity.

Discuss Duration. Include in your discussion what duration measures, how duration relates to maturity, what

variables affect duration, and how duration is used as a portfolio management tool include some of the problems

associated with the use of duration as a portfolio management tool

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock