Question: 5. A. Using the columnar paper on the next page, construct a five-year comprehensive valuation model. Calculate the annual cash flows (including Sales, EBIT, NOPAT)

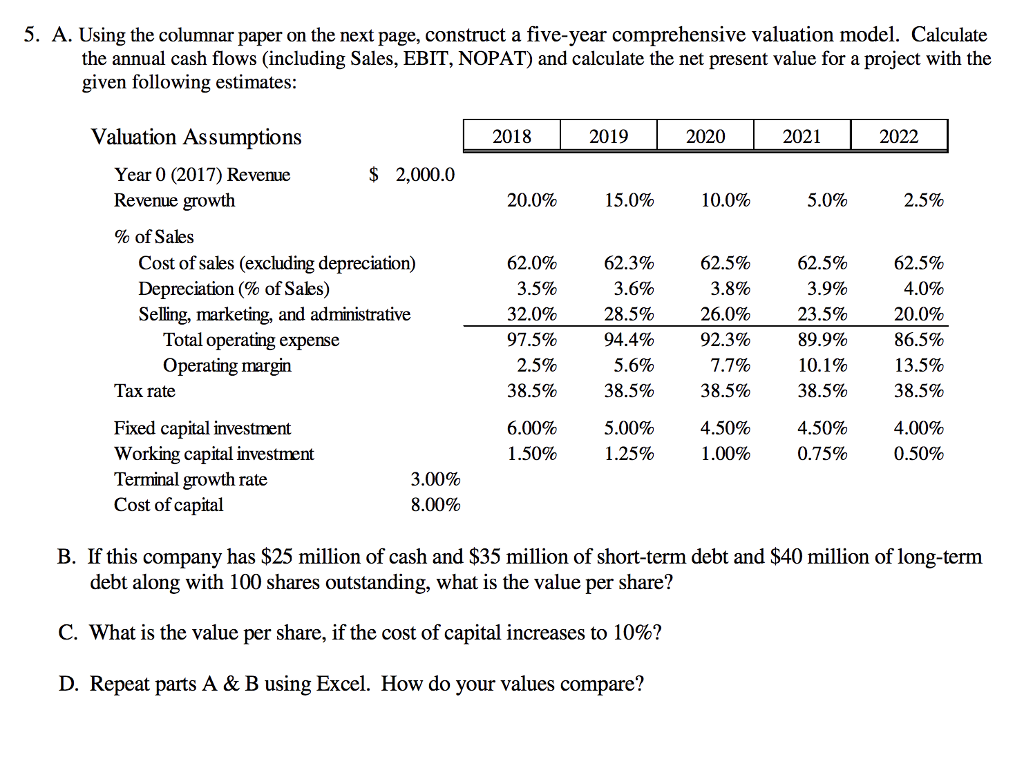

5. A. Using the columnar paper on the next page, construct a five-year comprehensive valuation model. Calculate the annual cash flows (including Sales, EBIT, NOPAT) and calculate the net present value for a project with the given following estimates Valuation Assumptions 2018 2019 2020 2021 2022 $ 2,000.0 Year 0 (2017) Revenue Revenue growth % of Sales 20.0% 15.0% 10.0% 5.0% 25% 62.0% 35% 32.0% 97.5% 2.5% 38.5% 623% 3.6% 28.5% 94.4% 55% 38.5% 5.00% 1.25% 625% 3 990 23.5% 89.9% 10.1% 38.5% 625% 4.0% 20.0% 86.5% 13.5% 38.5% 4.00% 0.50% Cost of sales (excluding depreciation) Depreciation (% of Sales) Seling, marketing, and administrative 625% 26.0% 92.3% Total operating expense Operating margin 38.5% 4.50% 1.00% Tax rate 4.50% 0.75% Fixed capital investment Working capital investment Terminal growth rate Cost of capital 1 .50% 3.00% 8.00% B. If this company has $25 million of cash and $35 million of short-term debt and $40 million of long-term debt along with 100 shares outstanding, what is the value per share? C. What is the value per share, if the cost of capital increases to 10%? D. Repeat parts A & B using Excel. How do your values compare

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts