Question: 5) ACME, Inc. expects its current annual $2 50 per share common stoek dividend to remain the same for the foresceable future. Therefore, the value

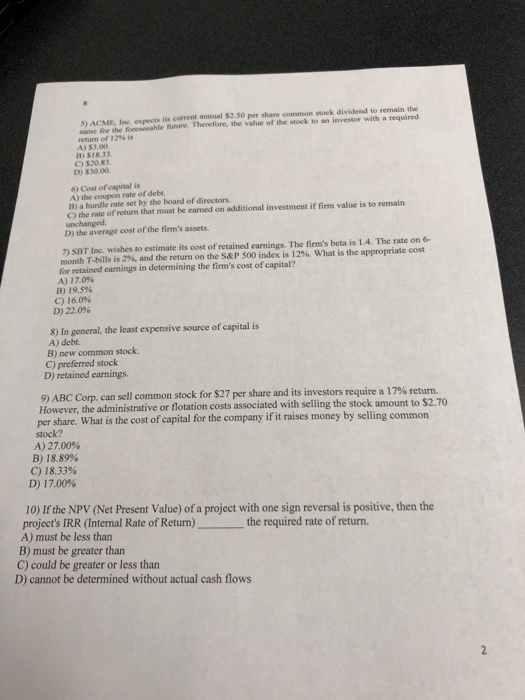

5) ACME, Inc. expects its current annual $2 50 per share common stoek dividend to remain the same for the foresceable future. Therefore, the value of the stock to an investor with a required return of 12% is A) 53,00 B) $18.33 C) 520.83 D) $30.00 6) Cost of capital is A) the coupon rate of debt B) a hurdle rate set by the board of directors. C) the rate of return that must be carned on additional investment if firm value is to remain unchanged D) the average cost of the firm's assets 7) SBT Inc. wishes to estimate its cost of retained earnings. The firm's beta is 1.4. The rate on 6- month T-bills is 29, and the return on the S&P 500 index is 12%, what is the appropriate cost for retained carnings in determining the firm's cost of capital? A) 17.0% B) 19.5% C) 16.0% D) 22.0% 8) In general, the least expensive source of capital is A) debt. B) new common stock. C) preferred stock D) retained earnings. 9) ABC Corp. can sell common stock for $27 per share and its investors require a 17% return. However, the administrative or flotation costs associated with selling the stock amount to $2.70 per share. What is the cost of capital for the company if it raises money by selling common stock? A) 27.00% B) 18.89% C) 18.33% D) 17.00% 10) If the NPV (Net Present Value) of a project with one sign reversal is positive, then the project's IRR (Internal Rate of Return) the required rate of return. A) must be less than B) must be greater than C) could be greater or less than D) cannot be determined without actual cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts