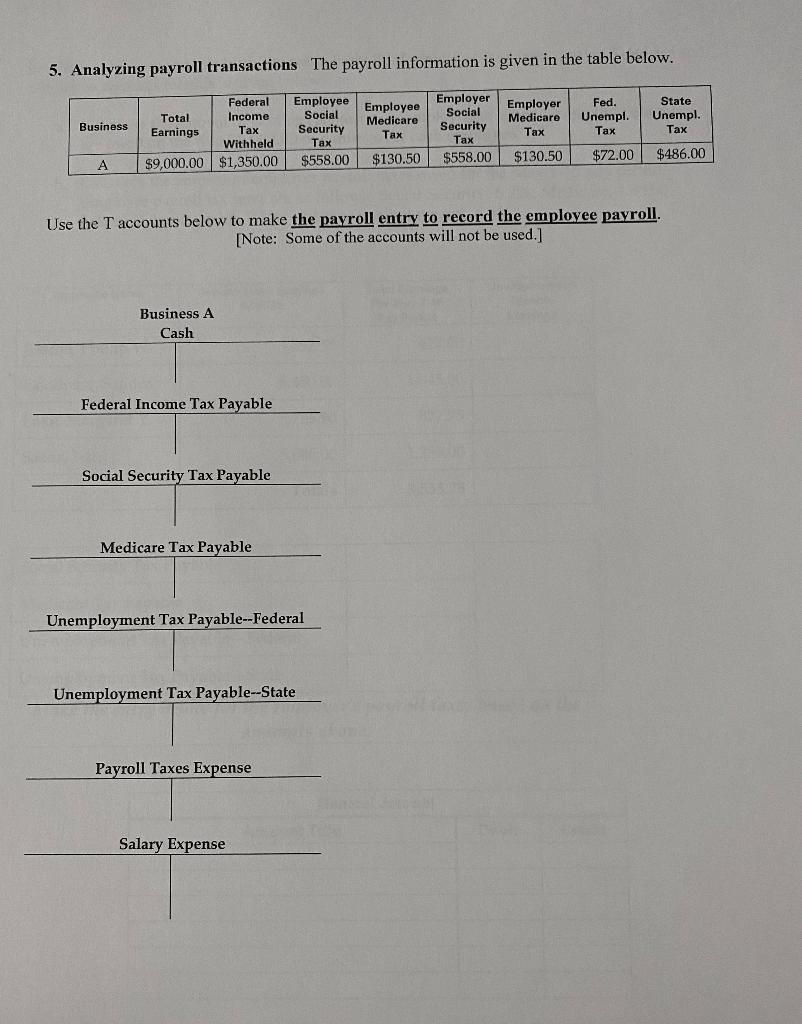

Question: 5. Analyzing payroll transactions The payroll information is given in the table below. Employer Social Federal Total Income Earnings Tax Withheld $9,000.00 $1,350.00 Employee Social

5. Analyzing payroll transactions The payroll information is given in the table below. Employer Social Federal Total Income Earnings Tax Withheld $9,000.00 $1,350.00 Employee Social Security Tax $558.00 Employee Medicare Tax Employer Medicare Tax Fed. Unempl. Tax Business State Unempl. Tax Security Tax $558.00 $130.50 $130.50 $72.00 A $486.00 Use the T accounts below to make the payroll entry to record the employee payroll. [Note: Some of the accounts will not be used.] Business A Cash Federal Income Tax Payable Social Security Tax Payable Medicare Tax Payable Unemployment Tax Payable--Federal Unemployment Tax Payable--State Payroll Taxes Expense Salary Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts