Question: 5. Basic concepts I Select the correct term for each of the following descriptions. Descriptions Terms Also called the maturity matching approach, this current asset

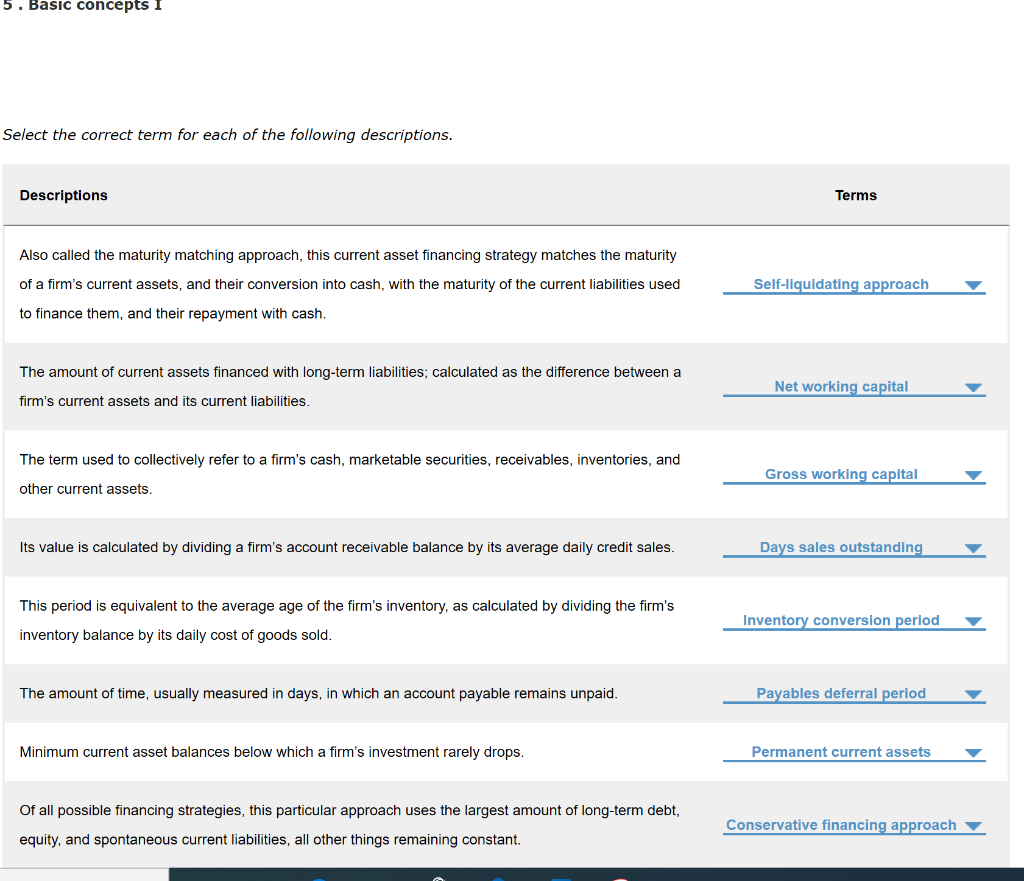

5. Basic concepts I Select the correct term for each of the following descriptions. Descriptions Terms Also called the maturity matching approach, this current asset financing strategy matches the maturity of a firm's current assets, and their conversion into cash, with the maturity of the current liabilities used Self-liquidating approach to finance them, and their repayment with cash. The amount of current assets financed with long-term liabilities; calculated as the difference between a Net working capital firm's current assets and its current liabilities. The term used to collectively refer to a firm's cash, marketable securities, receivables, inventories, and Gross working capital other current assets. Its value is calculated by dividing a firm's account receivable balance by its average daily credit sales. Days sales outstanding This period is equivalent to the average age of the firm's inventory, as calculated by dividing the firm's inventory balance by its daily cost of goods sold. Inventory conversion period The amount of time, usually measured in days, in which an account payable remains unpaid. Payables deferral period Minimum current asset balances below which a firm's investment rarely drops. Permanent current assets Of all possible financing strategies, this particular approach uses the largest amount of long-term debt, equity, and spontaneous current liabilities, all other things remaining constant. Conservative financing approach 5. Basic concepts I Select the correct term for each of the following descriptions. Descriptions Terms Also called the maturity matching approach, this current asset financing strategy matches the maturity of a firm's current assets, and their conversion into cash, with the maturity of the current liabilities used Self-liquidating approach to finance them, and their repayment with cash. The amount of current assets financed with long-term liabilities; calculated as the difference between a Net working capital firm's current assets and its current liabilities. The term used to collectively refer to a firm's cash, marketable securities, receivables, inventories, and Gross working capital other current assets. Its value is calculated by dividing a firm's account receivable balance by its average daily credit sales. Days sales outstanding This period is equivalent to the average age of the firm's inventory, as calculated by dividing the firm's inventory balance by its daily cost of goods sold. Inventory conversion period The amount of time, usually measured in days, in which an account payable remains unpaid. Payables deferral period Minimum current asset balances below which a firm's investment rarely drops. Permanent current assets Of all possible financing strategies, this particular approach uses the largest amount of long-term debt, equity, and spontaneous current liabilities, all other things remaining constant. Conservative financing approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts