Question: 5. Bill receives a proportionate liquidating distribution when the basis of his partnership interest is $80,000. His distribution includes cash of $100,000, inventory (FMV =

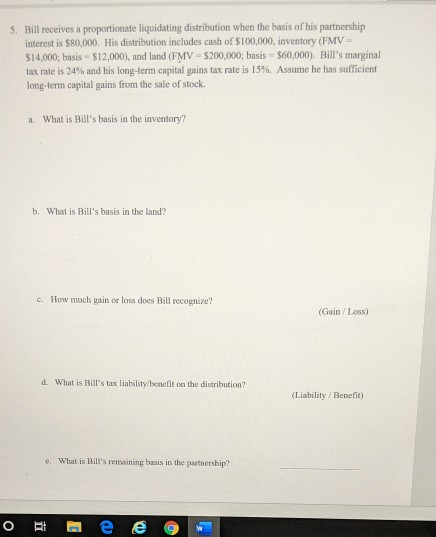

5. Bill receives a proportionate liquidating distribution when the basis of his partnership interest is $80,000. His distribution includes cash of $100,000, inventory (FMV = $14,000; basis $12,000), and land (FMV -$200,000; basis - $60,000). Bill's marginal tax rate is 24% and his long-term capital gains tax rate is 15%. Assume he has sufficient long-term capital gains from the sale of stock. a. What is Bill's basis in the inventory? b. What is Bill's basis in the land? c. How much gain or loss does Bill recognize? (Gain/Loss) d. What is Bull's tax liability/benefit on the distribution? (Liability / Benefit) What is Bill's remaining basis in the partnership

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts