Question: (5) Bond A is currently selling at a premium while Bond B is currently selling a discount. Both bonds still have 5 years to maturity.

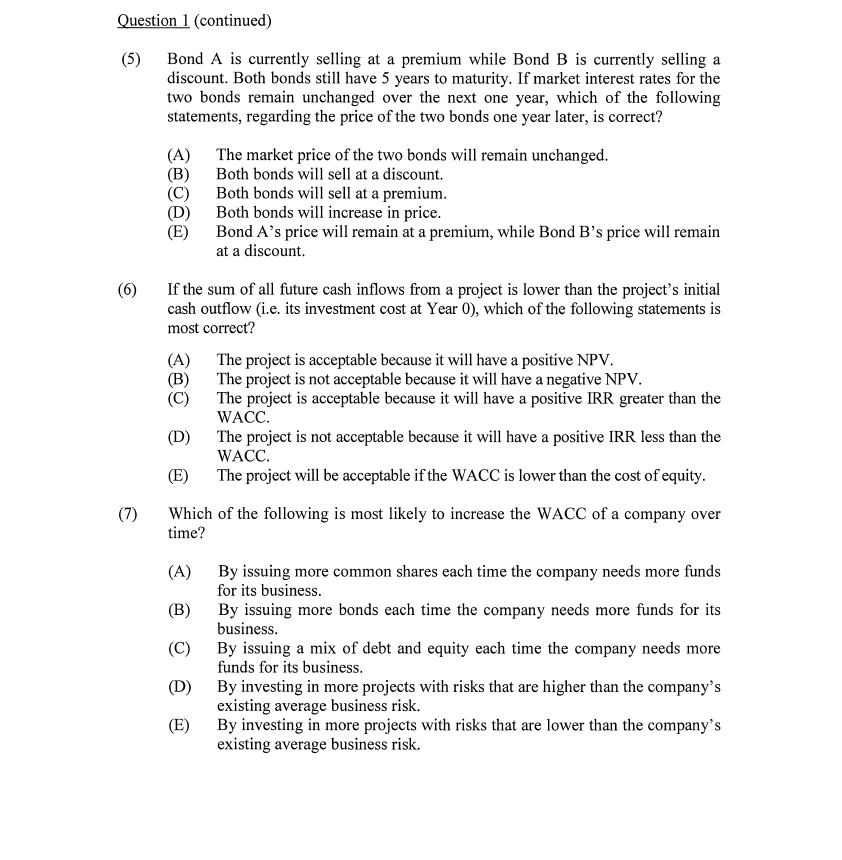

(5) Bond A is currently selling at a premium while Bond B is currently selling a discount. Both bonds still have 5 years to maturity. If market interest rates for the two bonds remain unchanged over the next one year, which of the following statements, regarding the price of the two bonds one year later, is correct? (A) The market price of the two bonds will remain unchanged. (B) Both bonds will sell at a discount. (C) Both bonds will sell at a premium. (D) Both bonds will increase in price. (E) Bond A's price will remain at a premium, while Bond B's price will remain at a discount. (6) If the sum of all future cash inflows from a project is lower than the project's initial cash outflow (i.e. its investment cost at Year 0), which of the following statements is most correct? (A) The project is acceptable because it will have a positive NPV. (B) The project is not acceptable because it will have a negative NPV. (C) The project is acceptable because it will have a positive IRR greater than the WACC. (D) The project is not acceptable because it will have a positive IRR less than the WACC. (E) The project will be acceptable if the WACC is lower than the cost of equity. (7) Which of the following is most likely to increase the WACC of a company over time? (A) By issuing more common shares each time the company needs more funds for its business. (B) By issuing more bonds each time the company needs more funds for its business. (C) By issuing a mix of debt and equity each time the company needs more funds for its business. (D) By investing in more projects with risks that are higher than the company's existing average business risk. (E) By investing in more projects with risks that are lower than the company's existing average business risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts