Question: 5. Bond yields and prices over time Aa Aa E A bond investor is analyzing the following annual coupon bonds: Issuing Company Annual Coupon Rate

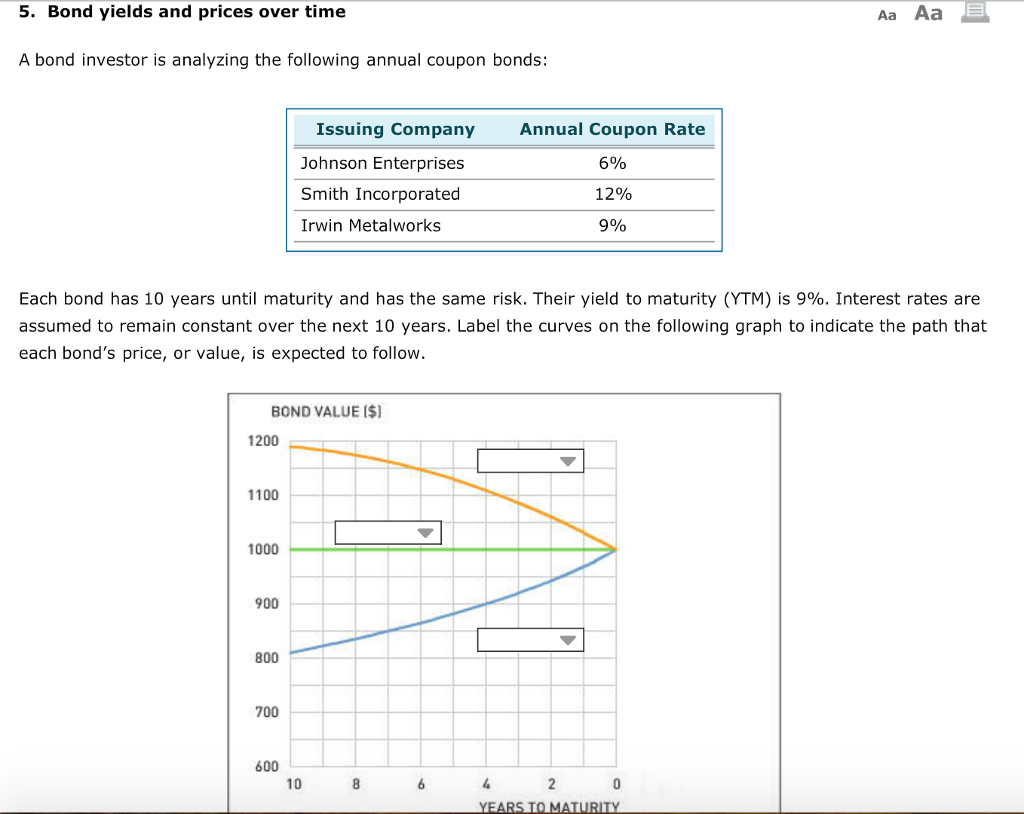

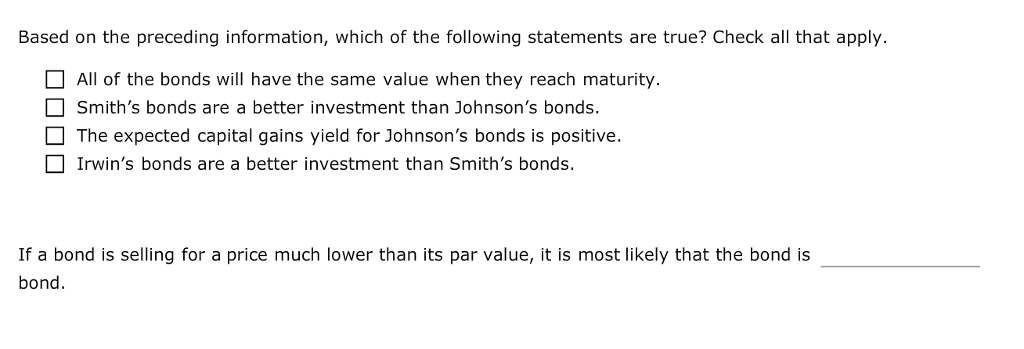

5. Bond yields and prices over time Aa Aa E A bond investor is analyzing the following annual coupon bonds: Issuing Company Annual Coupon Rate Johnson Enterprises 6% Smith Incorporated 12% Irwin Metalworks 9% Each bond has 10 years until maturity and has the same risk. Their yield to maturity (YTM) is 9%. Interest rates are assumed to remain constant over the next 10 years. Label the curves on the following graph to indicate the path that each bond's price, or value, is expected to follow. BOND VALUE ($) 1200 1100 1000 900 3 3 3 3 3 800 700 600 YEARS TO MATURITY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts