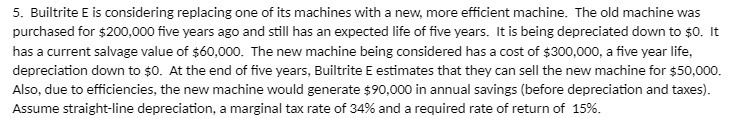

Question: 5 . Builtrite E is considering replacing one of its machines with a new, more Efficient machine . The old machine was purchased for $

5 . Builtrite E is considering replacing one of its machines with a new, more Efficient machine . The old machine was purchased for $ 200,0 00 five years ago and still has an expected life of five years . It is being depreciated down to 50 . It has a current salvage value of $ 60, 00. The new machi chine being considered has a cost of $ 300, 000, a five year life . depreciation down to $0 . At the End of five years , Builtrite E Estimates that they can sell the new machine for $ 50, 000. Also , due to Efficiencies , the new machine would generate $ 90, 000 in annual savings ( before depreciation and taxes). Assume Straight- line depreciation , a marginal tax rate of 34%6 and a required rate of return of 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts