Question: 5 - C . Part . Capital Projects Fund TransactionsThe voters of the City of Monroe approved the issuance of tax - supported bonds in

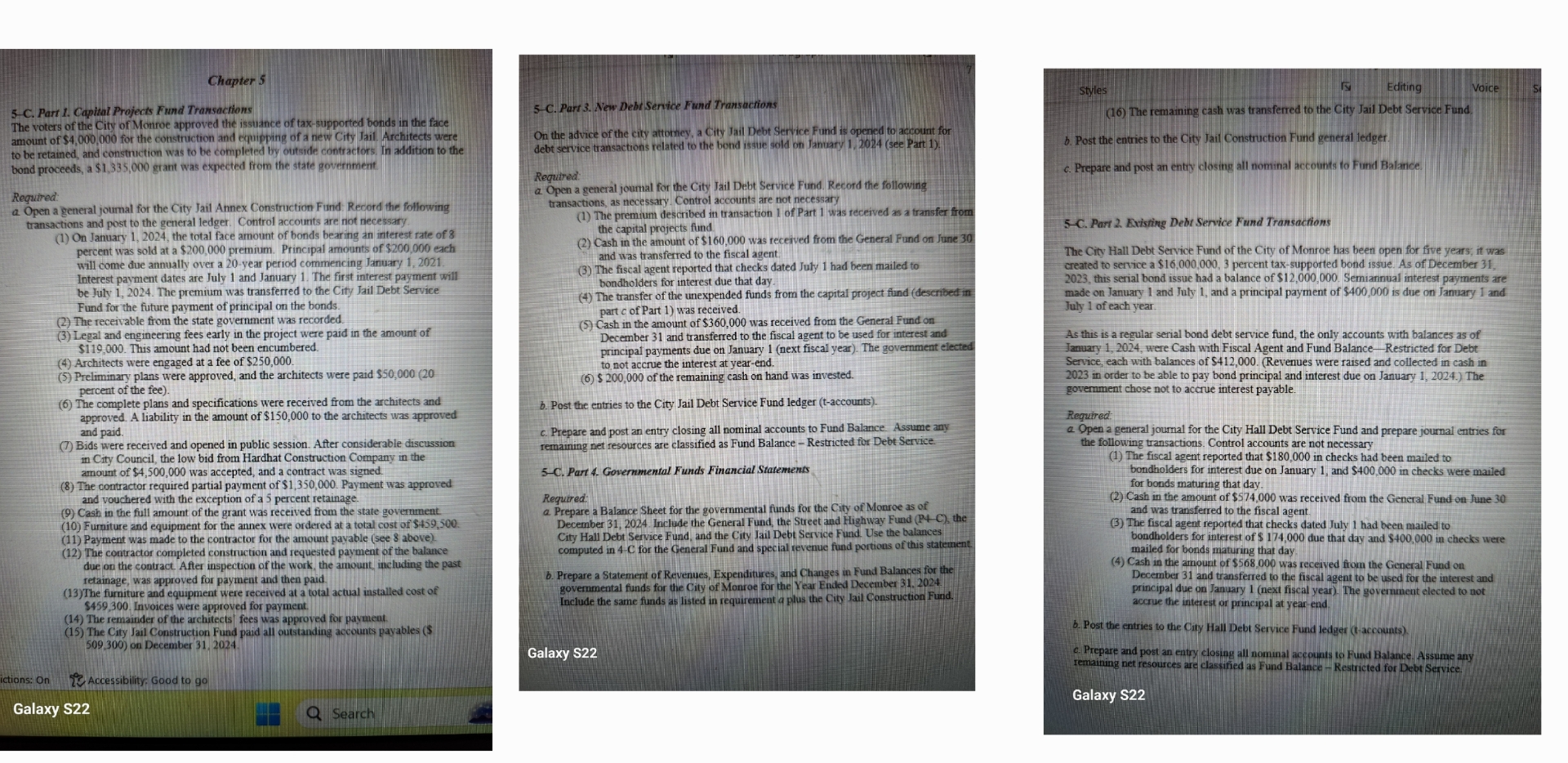

C Part Capital Projects Fund TransactionsThe voters of the City of Monroe approved the issuance of taxsupported bonds in the faceamount of$ for the costruction and euipping of a new City Tail Architects wereto be retained, and constrction was to be completed Hy ottide contractors Tn addition to thebond proceeds, a S erant was expected from the state governmentRequiredChaptera Opena general joumal for the City Jail Annex Construction Fund Record the fotfowingtransactions and piost to the se general ledger. Controf accounts are not necessary On January the total face arnount of t bearing an interest rate of ercent was sold at a $ premium Principal amounts of eachwill come due annally overa year period conmencing January Interest pavment dates are July and January The first interest payment willbe Juty l The premium was transferred to the City Jail Debt Service The receivable from the state government was recordedLegal and engineering fees early in the project were paid in the amount ofSI This amount had not been encumbered. Architects were engaged at a fee of $ Preliminary plans were approved, and the architects were paid $percent of the fee The complete plans and specifications were received from the architects andapproved. A liability in the amount of S to the architects was approvedand pao.naid Bids were received and opened in public session. After considerable discussionn City Council, the low bid from H Constr on Company n theostrutonHardn contra The contractor required partial payment of $ Payment was approvedand vouchered with the exception of a percent retainage Cash in the full amount of the grant was received from the state government Furniture and equipment for the annex were ordered at a total cost of S Payment was made to the contactor for the amount payable see S above The contractor completed construction and requested payment of the balancesigdue on the contract Afer inspection of the work, he amount. inchuding the pastretainage, was approved for payment and then paid.The furniture and equipment were received at a total actual installed cost ofS Invoices were approved for paymentGalaxy S The renmainder of the architects fees was approyed for paymeatictions: OnAccessibility. Good to go The City Jail Construction Fund paid all outstanding accounts payables $ on December QSearchsC. Part New Debt Sertce Fund TransactionsOn the advice of the city attotiey, a City ail Debt Service Fund is opened to accournt fordebt service transactions related to the bond isse sold on January see Pat Requtreda Open a general joumal for the City Jail Debt Service Fubd. Record the followingtransactions, as necessary Control accounts are not necessaty The premium desoribed in transaction of Part was received as a transfer fromthe capital projects fund Cash in the amount of $ was teceived from the General Fund om June and was transferred to the fiscal agent The fiscal agent reported that checks dated Juty had been mailed tebondholders for interest due that day. The transfer of the unexpended funds fromn the capital project fund described inpart c of Part was received.Cash in the amount of S was received from the General Fund on $ of the remaining cash on hand was invested.December and transferred to the fiscal agent to be used for interest andprincipalf payments due on January next fiscal year The government electedto not accrue the interest at yearend.b Post the entries to the City Jail Debt Service Fund ledger taccountsc Prepare and post an entry closing all nominal accounts to Fund Balance Assume anyrernaning net resources are classified as Fund Balance Restricted for Debt ServiceC Par Gosernmental Funds Financial StatementsRequired.Prepare a Balance eetoDecembe Pfor theGalaxy Snd h Sueet and Hiehway Fund Ohcfunds for the City of Monroe as ofJa Debt Service Fund Use the balancesCity Hall Debt Sereecomputed in C for the General Fund and special revenue fund portions of this statementPrepare a Statement of Revenues, Expenditures, and Changes in Fund Balances for theamental funds for the City of Monroe for the Year Ended December Include the sarne funds as listed in requirementa plus the City Jail Construction Fund.Styles The remaining cash was tranisfered to the City Jail Debt Service Fund Post the entries to the City Jail Constriction Fund general ledger.c Prepare and post an entry closing all nominal accounts to Fund BalanceC Part Evisting Debt Service Fund TransactionsEditingThe City Hall Debt Service Fund of the City of Montoe has beem open for five years, it wasareated to service a $ percent taxsupported bond issue. As of December this serial bond issue had a balance ofS Semiann

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock