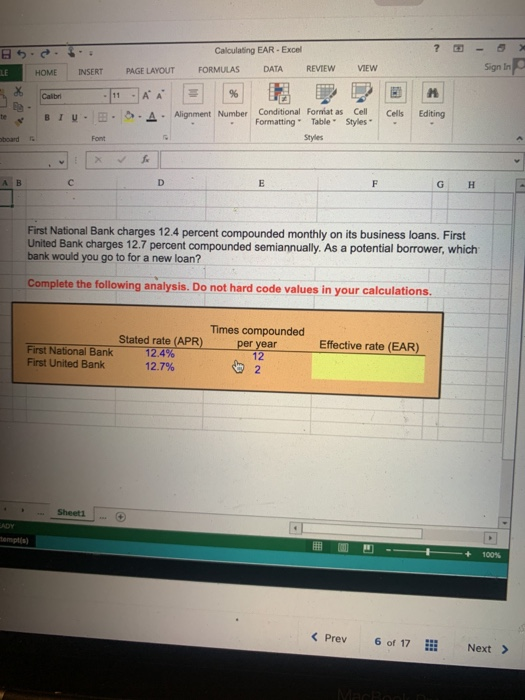

Question: ? 5 Calculating EAR-Excel FORMULAS DATA REVIEW TE HOME INSERT PAGE LAYOUT VIEW Sign in Calibri - A A % Cells te BIU- Cell Styles

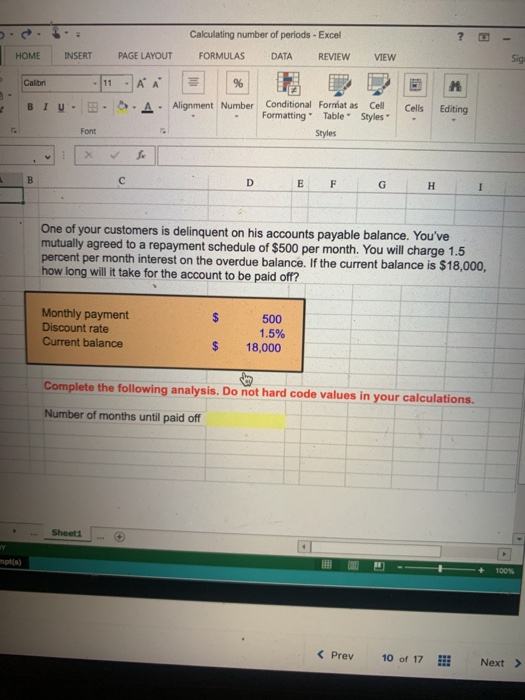

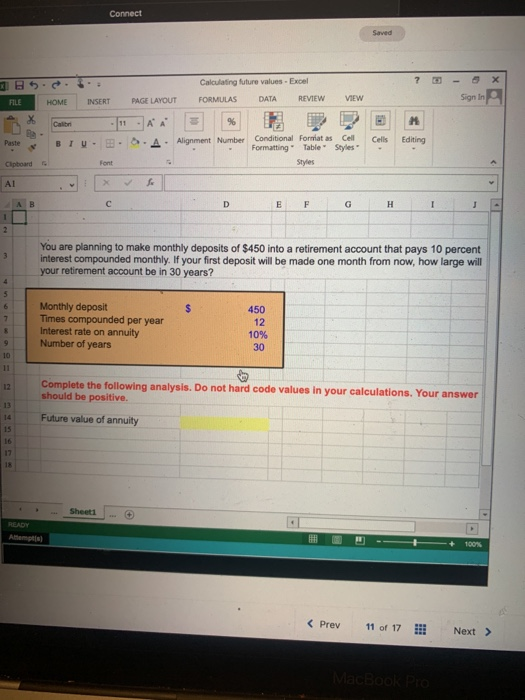

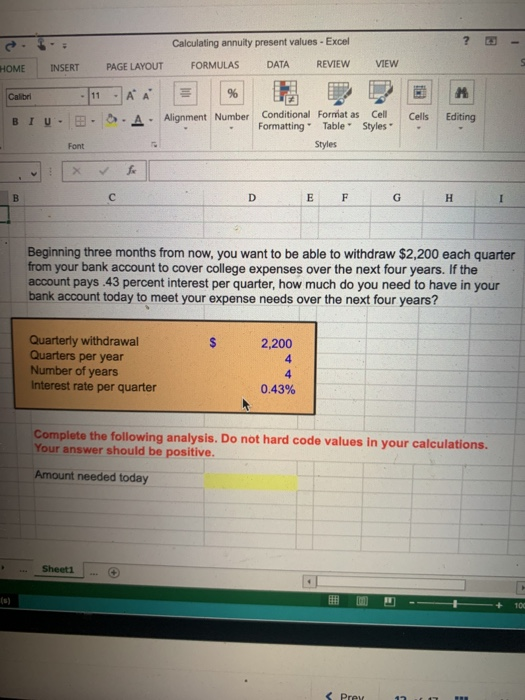

? 5 Calculating EAR-Excel FORMULAS DATA REVIEW TE HOME INSERT PAGE LAYOUT VIEW Sign in Calibri - A A % Cells te BIU- Cell Styles Alignment Number Conditional Forwiatas Formatting Table Styles Editing Font So + AB D E F G H First National Bank charges 12.4 percent compounded monthly on its business loans. First United Bank charges 12.7 percent compounded semiannually. As a potential borrower, which bank would you go to for a new loan? Complete the following analysis. Do not hard code values in your calculations. Times compounded Stated rate (APR) per year First National Bank 12.4% 12 First United Bank 12.7% 2 Effective rate (EAR) Sheeti SADY 100% Calculating number of periods - Excel HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sig Calibri 11 A % M BIU- A Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Font X B D F G H I One of your customers is delinquent on his accounts payable balance. You've mutually agreed to a repayment schedule of $500 per month. You will charge 1.5 percent per month interest on the overdue balance. If the current balance is $18,000, how long will it take for the account to be paid off? $ Monthly payment Discount rate Current balance 500 1.5% 18,000 $ Complete the following analysis. Do not hard code values in your calculations. Number of months until paid off Sheet1 Y 100% Connect Saved ? Calculating future values - Excel FORMULAS DATA REVIEW FILE VIEW HOME INSERT PAGE LAYOUT Sign in a Calibri 11 - A A % Paste Cells BIU- SA. Editing Alignment Number Conditional Format as Cell Formatting Table Styles Styles Clipboard Font MacBook Calculating annuity present values - Excel INSERT HOME PAGE LAYOUT FORMULAS DATA REVIEW VIEW Calibri 11 A %% M BIU- Cells A Alignment Number - Editing Conditional Format as Cell Formatting" Table " Styles Styles Font fx B D E F G H I Beginning three months from now, you want to be able to withdraw $2,200 each quarter from your bank account to cover college expenses over the next four years. If the account pays.43 percent interest per quarter, how much do you need to have in your bank account today to meet your expense needs over the next four years? Quarterly withdrawal Quarters per year Number of years Interest rate per quarter 2,200 4 4 0.43% Complete the following analysis. Do not hard code values in your calculations. Your answer should be positive. Amount needed today Sheet1 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts