Question: 5. Calculating finance charges using the discount method and APR on a single-payment loan Aa Aa You are taking out a single-payment loan that uses

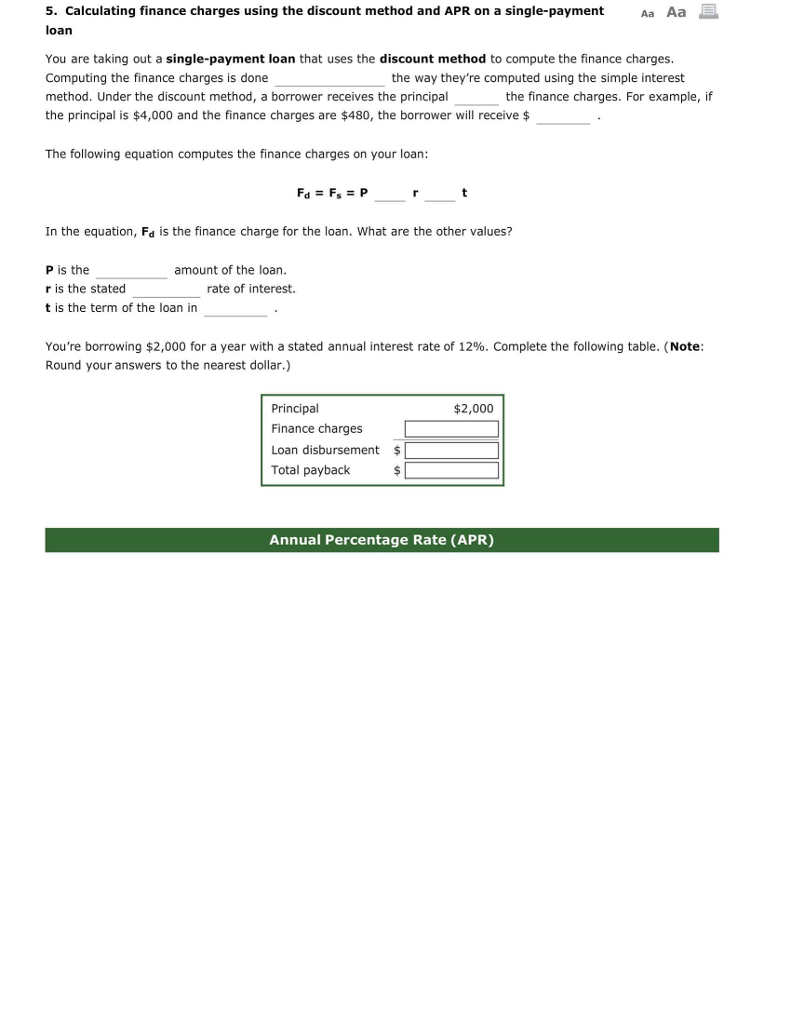

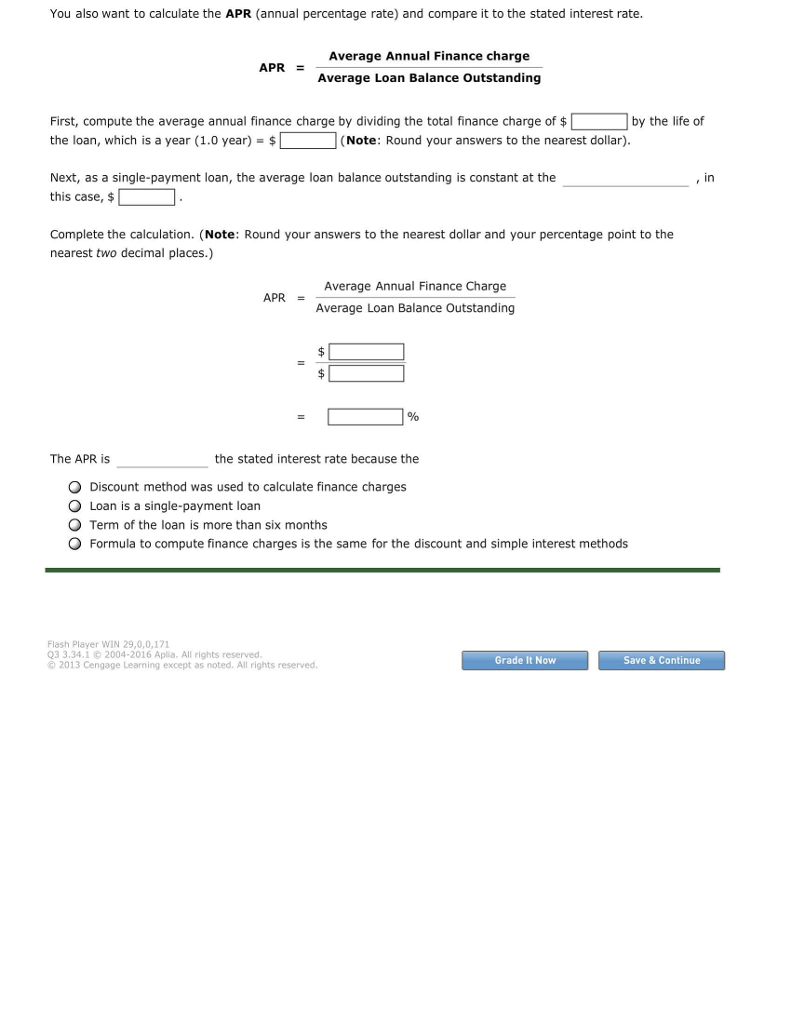

5. Calculating finance charges using the discount method and APR on a single-payment loan Aa Aa You are taking out a single-payment loan that uses the discount method to compute the finance charges. Computing the finance charges is done method. Under the discount method, a borrower receives the principal the principal is $4,000 and the finance charges are $480, the borrower will receive$ the way they're computed using the simple interest the finance charges. For example, if The following equation computes the finance charges on your loan In the equation, Fd is the finance charge for the loan. What are the other values? P is the r is the stated t is the term of the loan in amount of the loan. rate of interest. You're borrowing $2,000 for a year with a stated annual interest rate of 12%. Complete the following table. (Note: Round your answers to the nearest dollar.) Principal Finance charges Loan disbursement$ Total payback $ $2,000 Annual Percentage Rate (APR)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts