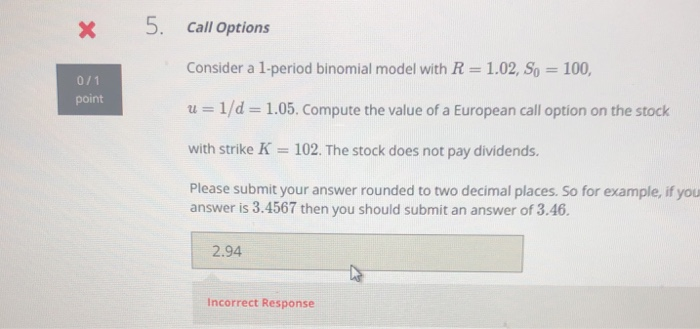

Question: 5. Call Options Consider a 1-period binomial model with R 1.02, So 100, 0/1 point u1/d 1.05. Compute the value of a European call option

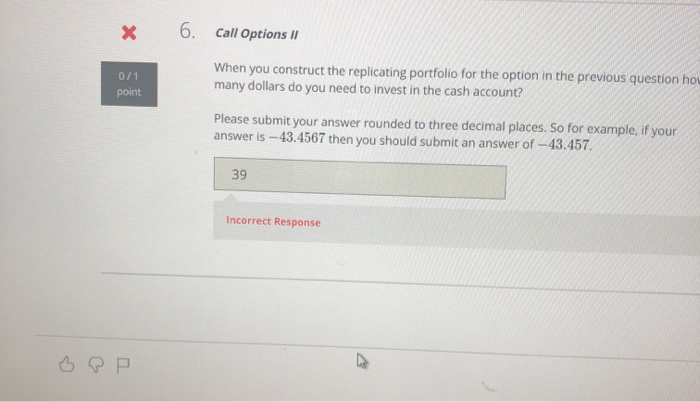

5. Call Options Consider a 1-period binomial model with R 1.02, So 100, 0/1 point u1/d 1.05. Compute the value of a European call option on the stock with strike K = 102. The stock does not pay dividends. Please submit your answer rounded to two decimal places. So for example, if you is 3.4567 then you should submit an answer of 3.46. answer 2.94 Incorrect Response X 6. x Call Options I When you construct the replicating portfolio for the option in the previous question ho many dollars do you need to invest in the cash account? 0/1 point Please submit your answer rounded to three decimal places. So for example, if your answer is-43.4567 then you should submit an answer of-43.457. 39 Incorrect Response P X\

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts