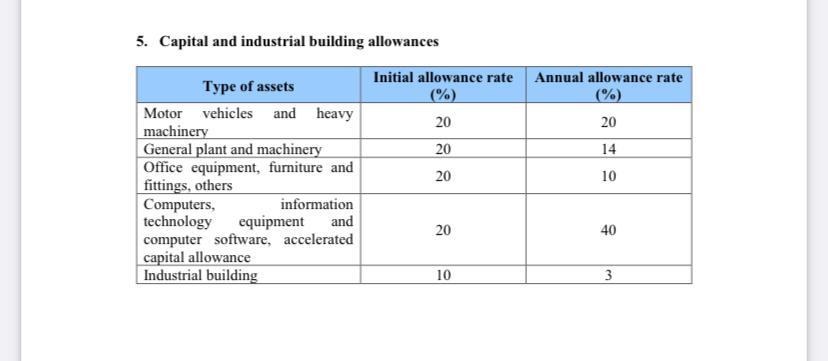

Question: 5. Capital and industrial building allowances Initial allowance rate (%) 20 20 Annual allowance rate (%) 20 14 Type of assets Motor vehicles and heavy

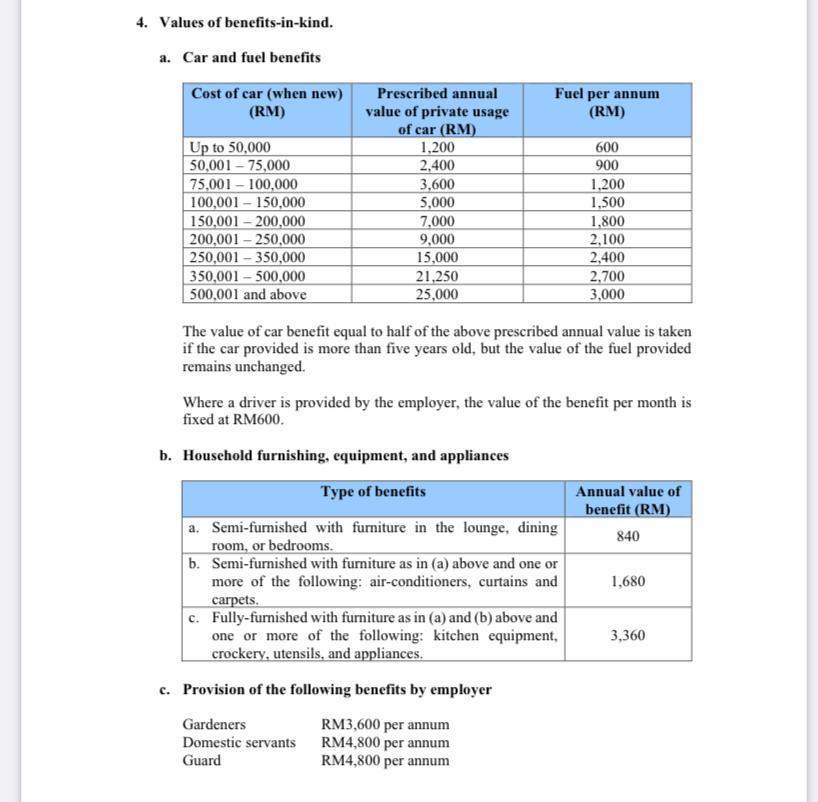

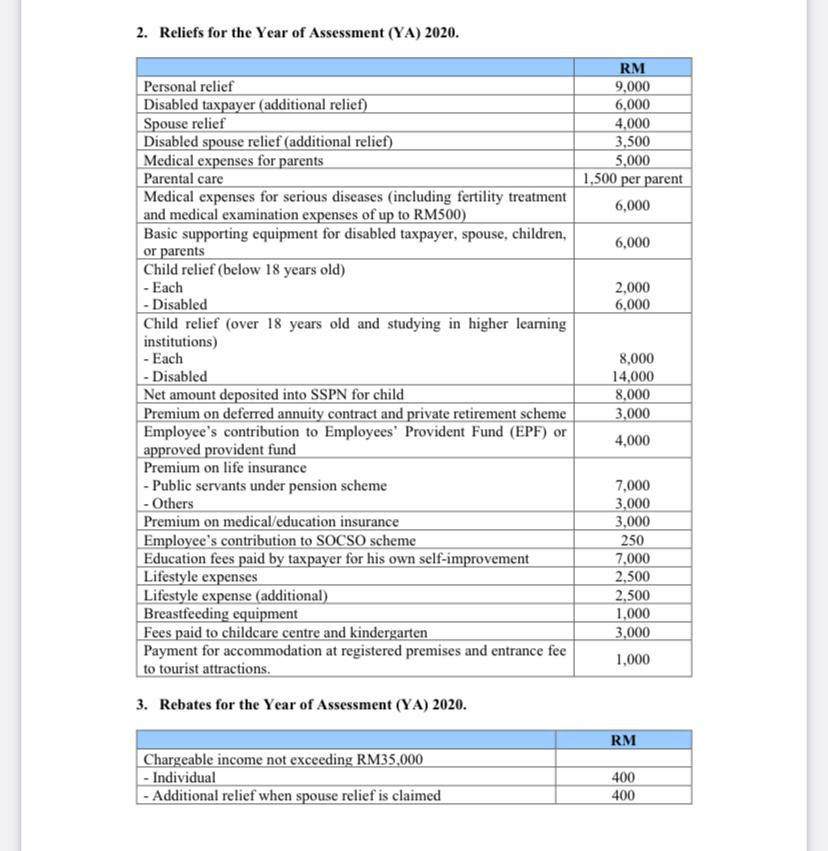

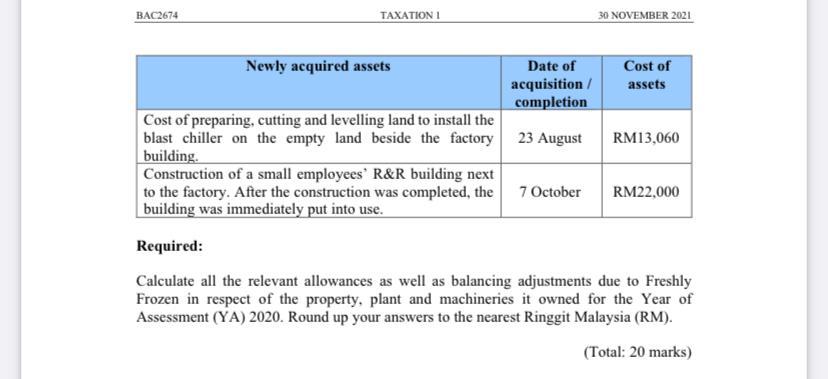

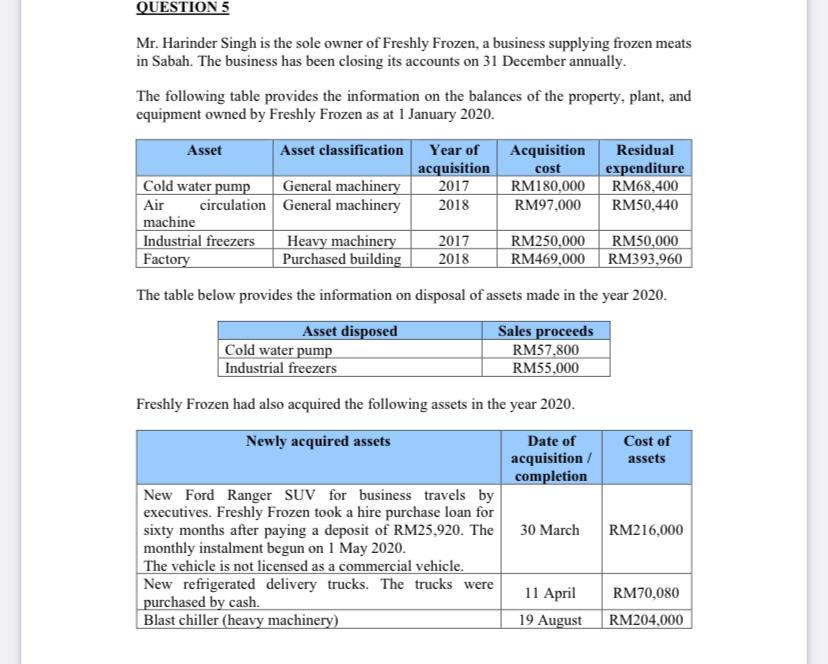

5. Capital and industrial building allowances Initial allowance rate (%) 20 20 Annual allowance rate (%) 20 14 Type of assets Motor vehicles and heavy machinery General plant and machinery Office equipment, furniture and fittings, others Computers, information technology equipment and computer software, accelerated capital allowance Industrial building 20 10 20 40 10 3 4. Values of benefits-in-kind. a. Car and fuel benefits Cost of car (when new) (RM) Fuel per annum (RM) Up to 50,000 50,001 - 75,000 75,001 - 100,000 100,001 - 150,000 150,001 - 200,000 200,001 - 250.000 250,001 - 350,000 350,001 - 500,000 500,001 and above Prescribed annual value of private usage of car (RM) 1,200 2,400 3,600 5,000 7,000 9,000 15,000 21,250 25,000 600 900 1.200 1,500 1,800 2,100 2,400 2,700 3,000 The value of car benefit equal to half of the above prescribed annual value is taken if the car provided is more than five years old, but the value of the fuel provided remains unchanged. Where a driver is provided by the employer, the value of the benefit per month is fixed at RM600. b. Household furnishing, equipment, and appliances Type of benefits Annual value of benefit (RM) 840 1,680 a. Semi-furnished with furniture in the lounge, dining room, or bedrooms. b. Semi-furnished with furniture as in (a) above and one or more of the following: air-conditioners, curtains and carpets. c. Fully-furnished with furniture as in (a) and (b) above and one or more of the following: kitchen equipment, crockery, utensils, and appliances. 3,360 c. Provision of the following benefits by employer Gardeners Domestic servants Guard RM3,600 per annum RM4,800 per annum RM4,800 per annum 2. Reliefs for the Year of Assessment (YA) 2020. RM 9,000 6,000 4,000 3,500 5,000 1.500 per parent 6,000 6,000 2,000 6,000 Personal relief Disabled taxpayer (additional relief) Spouse relief Disabled spouse relief (additional relief) Medical expenses for parents Parental care Medical expenses for serious diseases (including fertility treatment and medical examination expenses of up to RM500) Basic supporting equipment for disabled taxpayer, spouse, children, or parents Child relief (below 18 years old) - Each - Disabled Child relief (over 18 years old and studying in higher learning institutions) - Each - Disabled Net amount deposited into SSPN for child Premium on deferred annuity contract and private retirement scheme Employee's contribution to Employees' Provident Fund (EPF) or approved provident fund Premium on life insurance - Public servants under pension scheme - Others Premium on medical education insurance Employee's contribution to SOCSO scheme Education fees paid by taxpayer for his own self-improvement Lifestyle expenses Lifestyle expense (additional) Breastfeeding equipment Fees paid to childcare centre and kindergarten Payment for accommodation at registered premises and entrance fee to tourist attractions. 3. Rebates for the Year of Assessment (YA) 2020. 8,000 14,000 8,000 3,000 4,000 7,000 3,000 3,000 250 7,000 2,500 2,500 1,000 3,000 1,000 RM Chargeable income not exceeding RM35,000 - Individual - Additional relief when spouse relief is claimed 400 400 BAC2674 TAXATION 1 30 NOVEMBER 2021 Cost of assets Newly acquired assets Date of acquisition completion Cost of preparing, cutting and levelling land to install the blast chiller on the empty land beside the factory 23 August building Construction of a small employees' R&R building next to the factory. After the construction was completed, the 7 October building was immediately put into use. RM13,060 RM22,000 Required: Calculate all the relevant allowances as well as balancing adjustments due to Freshly Frozen in respect of the property, plant and machineries it owned for the Year of Assessment (YA) 2020. Round up your answers to the nearest Ringgit Malaysia (RM). (Total: 20 marks) QUESTION 5 Mr. Harinder Singh is the sole owner of Freshly Frozen, a business supplying frozen meats in Sabah. The business has been closing its accounts on 31 December annually. The following table provides the information on the balances of the property, plant, and equipment owned by Freshly Frozen as at 1 January 2020. Asset Asset classification Year of Acquisition Residual acquisition cost expenditure Cold water pump General machinery 2017 RM180,000 RM68,400 Air circulation General machinery 2018 RM97,000 RM50,440 machine Industrial freezers Heavy machinery 2017 RM250.000 RM50,000 Factory Purchased building 2018 RM469,000 RM393,960 The table below provides the information on disposal of assets made in the year 2020. Asset disposed Sales proceeds Cold water pump RM57,800 Industrial freezers RM55.000 Freshly Frozen had also acquired the following assets in the year 2020. Cost of assets Newly acquired assets Date of acquisition / completion New Ford Ranger SUV for business travels by executives. Freshly Frozen took a hire purchase loan for sixty months after paying a deposit of RM25,920. The 30 March monthly instalment begun on 1 May 2020. The vehicle is not licensed as a commercial vehicle. New refrigerated delivery trucks. The trucks were 11 April purchased by cash. Blast chiller (heavy machinery) 19 August RM216,000 RM70,080 RM204,000 5. Capital and industrial building allowances Initial allowance rate (%) 20 20 Annual allowance rate (%) 20 14 Type of assets Motor vehicles and heavy machinery General plant and machinery Office equipment, furniture and fittings, others Computers, information technology equipment and computer software, accelerated capital allowance Industrial building 20 10 20 40 10 3 4. Values of benefits-in-kind. a. Car and fuel benefits Cost of car (when new) (RM) Fuel per annum (RM) Up to 50,000 50,001 - 75,000 75,001 - 100,000 100,001 - 150,000 150,001 - 200,000 200,001 - 250.000 250,001 - 350,000 350,001 - 500,000 500,001 and above Prescribed annual value of private usage of car (RM) 1,200 2,400 3,600 5,000 7,000 9,000 15,000 21,250 25,000 600 900 1.200 1,500 1,800 2,100 2,400 2,700 3,000 The value of car benefit equal to half of the above prescribed annual value is taken if the car provided is more than five years old, but the value of the fuel provided remains unchanged. Where a driver is provided by the employer, the value of the benefit per month is fixed at RM600. b. Household furnishing, equipment, and appliances Type of benefits Annual value of benefit (RM) 840 1,680 a. Semi-furnished with furniture in the lounge, dining room, or bedrooms. b. Semi-furnished with furniture as in (a) above and one or more of the following: air-conditioners, curtains and carpets. c. Fully-furnished with furniture as in (a) and (b) above and one or more of the following: kitchen equipment, crockery, utensils, and appliances. 3,360 c. Provision of the following benefits by employer Gardeners Domestic servants Guard RM3,600 per annum RM4,800 per annum RM4,800 per annum 2. Reliefs for the Year of Assessment (YA) 2020. RM 9,000 6,000 4,000 3,500 5,000 1.500 per parent 6,000 6,000 2,000 6,000 Personal relief Disabled taxpayer (additional relief) Spouse relief Disabled spouse relief (additional relief) Medical expenses for parents Parental care Medical expenses for serious diseases (including fertility treatment and medical examination expenses of up to RM500) Basic supporting equipment for disabled taxpayer, spouse, children, or parents Child relief (below 18 years old) - Each - Disabled Child relief (over 18 years old and studying in higher learning institutions) - Each - Disabled Net amount deposited into SSPN for child Premium on deferred annuity contract and private retirement scheme Employee's contribution to Employees' Provident Fund (EPF) or approved provident fund Premium on life insurance - Public servants under pension scheme - Others Premium on medical education insurance Employee's contribution to SOCSO scheme Education fees paid by taxpayer for his own self-improvement Lifestyle expenses Lifestyle expense (additional) Breastfeeding equipment Fees paid to childcare centre and kindergarten Payment for accommodation at registered premises and entrance fee to tourist attractions. 3. Rebates for the Year of Assessment (YA) 2020. 8,000 14,000 8,000 3,000 4,000 7,000 3,000 3,000 250 7,000 2,500 2,500 1,000 3,000 1,000 RM Chargeable income not exceeding RM35,000 - Individual - Additional relief when spouse relief is claimed 400 400 BAC2674 TAXATION 1 30 NOVEMBER 2021 Cost of assets Newly acquired assets Date of acquisition completion Cost of preparing, cutting and levelling land to install the blast chiller on the empty land beside the factory 23 August building Construction of a small employees' R&R building next to the factory. After the construction was completed, the 7 October building was immediately put into use. RM13,060 RM22,000 Required: Calculate all the relevant allowances as well as balancing adjustments due to Freshly Frozen in respect of the property, plant and machineries it owned for the Year of Assessment (YA) 2020. Round up your answers to the nearest Ringgit Malaysia (RM). (Total: 20 marks) QUESTION 5 Mr. Harinder Singh is the sole owner of Freshly Frozen, a business supplying frozen meats in Sabah. The business has been closing its accounts on 31 December annually. The following table provides the information on the balances of the property, plant, and equipment owned by Freshly Frozen as at 1 January 2020. Asset Asset classification Year of Acquisition Residual acquisition cost expenditure Cold water pump General machinery 2017 RM180,000 RM68,400 Air circulation General machinery 2018 RM97,000 RM50,440 machine Industrial freezers Heavy machinery 2017 RM250.000 RM50,000 Factory Purchased building 2018 RM469,000 RM393,960 The table below provides the information on disposal of assets made in the year 2020. Asset disposed Sales proceeds Cold water pump RM57,800 Industrial freezers RM55.000 Freshly Frozen had also acquired the following assets in the year 2020. Cost of assets Newly acquired assets Date of acquisition / completion New Ford Ranger SUV for business travels by executives. Freshly Frozen took a hire purchase loan for sixty months after paying a deposit of RM25,920. The 30 March monthly instalment begun on 1 May 2020. The vehicle is not licensed as a commercial vehicle. New refrigerated delivery trucks. The trucks were 11 April purchased by cash. Blast chiller (heavy machinery) 19 August RM216,000 RM70,080 RM204,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts