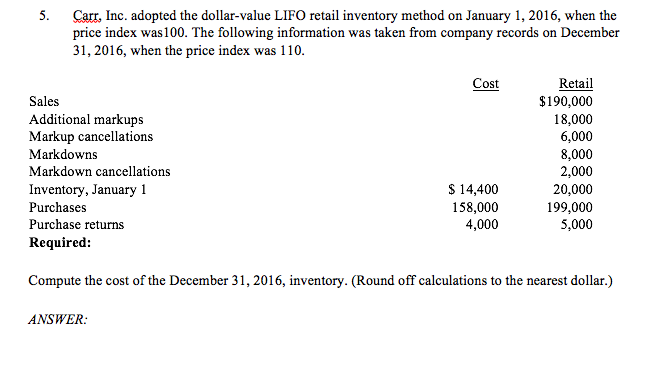

Question: 5. Carr, Inc. adopted the dollar-value LIFO retail inventory method on January 1, 2016, when the price index was 100. The following information was taken

5. Carr, Inc. adopted the dollar-value LIFO retail inventory method on January 1, 2016, when the price index was 100. The following information was taken from company records on December 31, 2016, when the price index was 110. Cost Sales Additional markups Markup cancellations Markdowns Markdown cancellations Inventory, January 1 Purchases Purchase returns Required: Retail $190,000 18,000 6,000 8,000 2,000 20,000 199,000 5,000 $ 14,400 158,000 4,000 Compute the cost of the December 31, 2016, inventory. (Round off calculations to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock