Question: 5. Chapter 13 Assignment - Saved to my Mac ayout References Mailings Review View Tell me ' ' Aa A 21 Aalbcdie Appe Avy Ov

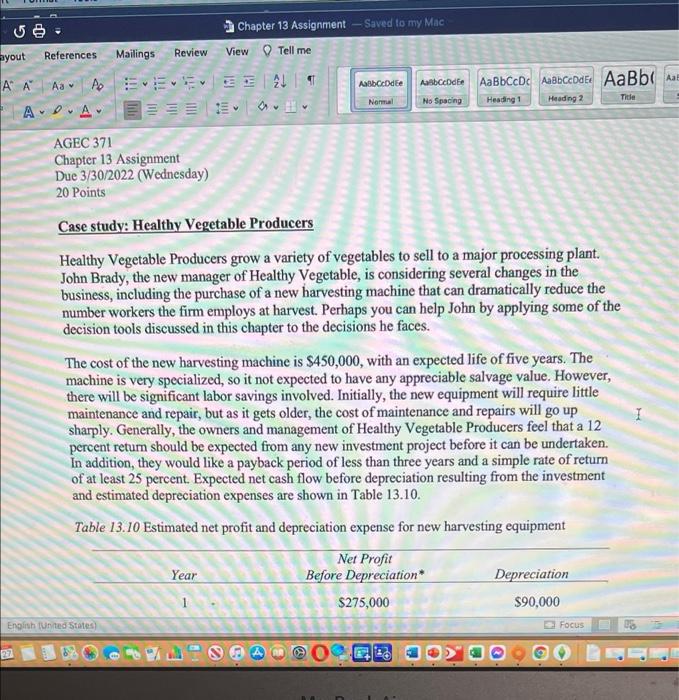

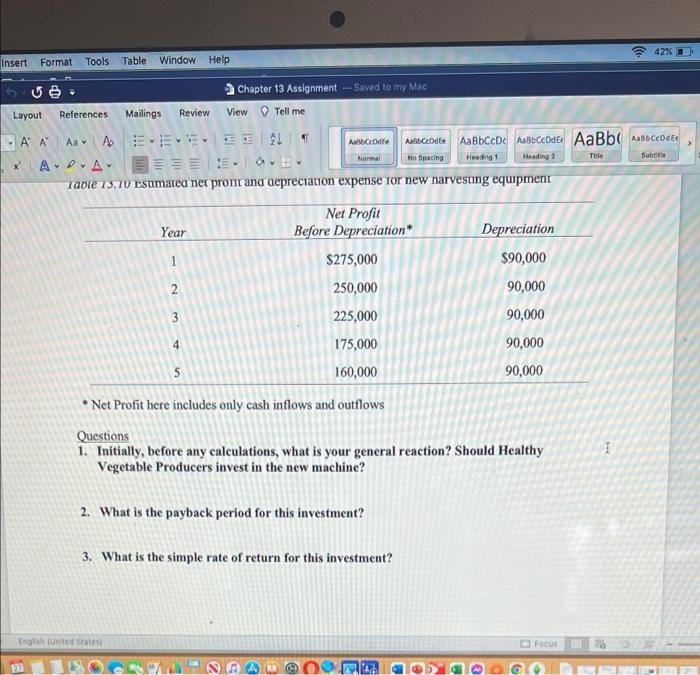

5. Chapter 13 Assignment - Saved to my Mac ayout References Mailings Review View Tell me ' ' Aa A 21 Aalbcdie Appe Avy Ov No Spacing Aal AanbCr die Normal Heading 1 Title Heading 2 AGEC 371 Chapter 13 Assignment Due 3/30/2022 (Wednesday) 20 Points Case study: Healthy Vegetable Producers Healthy Vegetable Producers grow a variety of vegetables to sell to a major processing plant. John Brady, the new manager of Healthy Vegetable, is considering several changes in the business, including the purchase of a new harvesting machine that can dramatically reduce the number workers the firm employs at harvest. Perhaps you can help John by applying some of the decision tools discussed in this chapter to the decisions he faces. The cost of the new harvesting machine is $450,000, with an expected life of five years. The machine is very specialized, so it not expected to have any appreciable salvage value. However, there will be significant labor savings involved. Initially, the new equipment will require little maintenance and repair, but as it gets older, the cost of maintenance and repairs will go up sharply. Generally, the owners and management of Healthy Vegetable Producers feel that a 12 percent return should be expected from any new investment project before it can be undertaken. In addition, they would like a payback period of less than three years and a simple rate of return of at least 25 percent. Expected net cash flow before depreciation resulting from the investment and estimated depreciation expenses are shown in Table 13.10. Table 13.10 Estimated net profit and depreciation expense for new harvesting equipment Net Profit Year Before Depreciation Depreciation $275,000 $90,000 Enginth (United States Focus 42% Insert Format Tools Table Window Help Jo. Chapter 13 Assignment - Saved to my Mac Layout References Mailings Review View Tell me 1 Normal Heading 2 Thie Suboti ' ' A Aanbodde Abedde AaBbceDc ABCDE AaBb Aabbed te ADA No Spacing Heading 1 Table 13.70 Esumarea ner pront and depreciation expense for new narvesting equipment X Year Net Profit Before Depreciation* $275,000 1 2 250,000 Depreciation $90,000 90,000 90,000 90,000 90,000 3 225,000 4 175,000 S 160,000 * Net Profit here includes only cash inflows and outflows Questions 1. Initially, before any calculations, what is your general reaction? Should Healthy Vegetable Producers invest in the new machine? 1 2. What is the payback period for this investment? 3. What is the simple rate of return for this investment? English (United States Focus NG