Question: 5) (Chapter 6 - 4 points) A stock is purchased for $25 and sold for $35 a year later. Additionally, the stock paid a $3

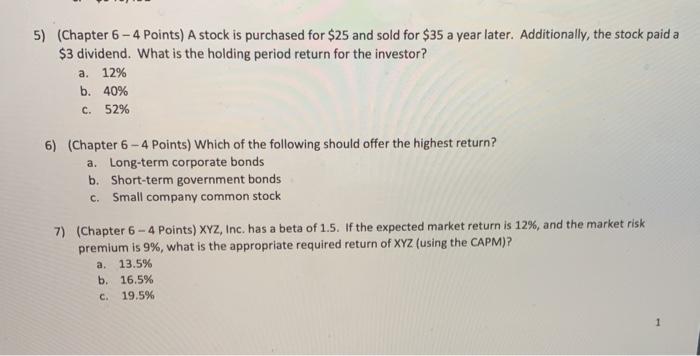

5) (Chapter 6 - 4 points) A stock is purchased for $25 and sold for $35 a year later. Additionally, the stock paid a $3 dividend. What is the holding period return for the investor? a. 12% b. 40% C. 52% 6) (Chapter 6 - 4 Points) Which of the following should offer the highest return? a. Long-term corporate bonds b. Short-term government bonds c. Small company common stock 7) (Chapter 6 - 4 Points) XYZ, Inc. has a beta of 1.5. If the expected market return is 12%, and the market risk premium is 9%, what is the appropriate required return of XYZ (using the CAPM)? a. 13.5% b. 16.5% C. 19.5% 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts