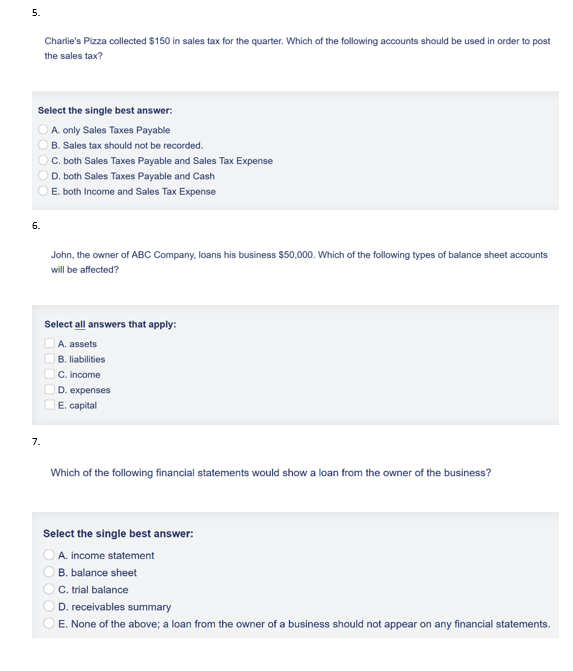

Question: 5 . Charlie's Pizza collected $ 1 5 0 in sales tax for the quarter. Which of the following accounts should be used in

Charlie's Pizza collected $ in sales tax for the quarter. Which of the following accounts should be used in order to post the sales tax?

Select the single best answer:

A only Sales Taxes Payable

B Sales tax should not be recorded.

C both Sales Taxes Payable and Sales Tax Expense

D both Sales Taxes Payable and Cash

E both Income and Sales Tax Expense

John, the owner of ABC Company, loans his business $ Which of the following types of balance sheet accounts will be affected?

Select all answers that apply:

A assets

B liabilities

C income

D expenses

E capital

Which of the following financial statements would show a loan from the owner of the business?

Select the single best answer:

A income statement

B balance sheet

C trial balance

D receivables summary

E None of the above; a loan from the owner of a business should not appear on any financial statements.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock