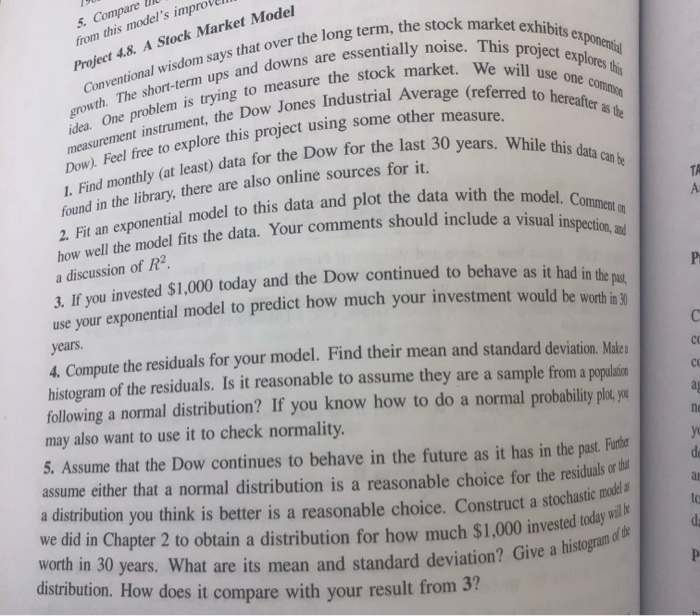

Question: 5. Compare the from this model's improvel Project 4.8. A Stock Market Model ong term, the stock market exhibit sentially noise. This project ex asure

5. Compare the from this model's improvel Project 4.8. A Stock Market Model ong term, the stock market exhibit sentially noise. This project ex asure the stock market. We will use et exhibits exponential project explores this will use one common (referred to hereafter as the growth. The short-term Conventional wisdom says that over the long term The short-term ups and downs are essentially idea. One problem is trying to measure the st measurement instrument, the Dow Jones Dow). Feel free to explore this project usin 1. Find monthly (at least) data for the Dow vears. While this data can be ata with the model. Comment on the Dow Jones Industrial Average (referrer plore this project using some other measure. ast) data for the Dow for the last 30 years. Wi found in the library, there are also online sources for it. 2. Fit an exponential model to this data and how well the model fits the data. Your comments should a discussion of R2 omments should include a visual inspection u continued to behave as it had in the past, 3. If you invested $1,000 today and the Dow continued to behave ential model to predict how much your investment would be worth in 30 use your exponential model to predict how muc years. Compute the residuals for your model. Find their mean and standard deviation Male histogram of the residuals. Is it reasonable to assume they are a sample from a population following a normal distribution? If you know how to do a normal probability plot, you may also want to use it to check normality. 5. Assume that the Dow continues to behave in the future as it has in the past. Purta assume either that a normal distribution is a reasonable choice for the residuals a distribution you think is better is a reasonable choice. Construct a stoch we did in Chapter 2 to obtain a distribution for how much $1,000 invested to worth in 30 years. What are its mean and standard deviation? distribution. How does it compare with your result from instruct a stochastic modela 1,000 invested today will be deviation? Give a histogram of de # 5 Only! 5. Compare the from this model's improvel Project 4.8. A Stock Market Model ong term, the stock market exhibit sentially noise. This project ex asure the stock market. We will use et exhibits exponential project explores this will use one common (referred to hereafter as the growth. The short-term Conventional wisdom says that over the long term The short-term ups and downs are essentially idea. One problem is trying to measure the st measurement instrument, the Dow Jones Dow). Feel free to explore this project usin 1. Find monthly (at least) data for the Dow vears. While this data can be ata with the model. Comment on the Dow Jones Industrial Average (referrer plore this project using some other measure. ast) data for the Dow for the last 30 years. Wi found in the library, there are also online sources for it. 2. Fit an exponential model to this data and how well the model fits the data. Your comments should a discussion of R2 omments should include a visual inspection u continued to behave as it had in the past, 3. If you invested $1,000 today and the Dow continued to behave ential model to predict how much your investment would be worth in 30 use your exponential model to predict how muc years. Compute the residuals for your model. Find their mean and standard deviation Male histogram of the residuals. Is it reasonable to assume they are a sample from a population following a normal distribution? If you know how to do a normal probability plot, you may also want to use it to check normality. 5. Assume that the Dow continues to behave in the future as it has in the past. Purta assume either that a normal distribution is a reasonable choice for the residuals a distribution you think is better is a reasonable choice. Construct a stoch we did in Chapter 2 to obtain a distribution for how much $1,000 invested to worth in 30 years. What are its mean and standard deviation? distribution. How does it compare with your result from instruct a stochastic modela 1,000 invested today will be deviation? Give a histogram of de # 5 Only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts