Question: 5. Consider a $1,000 par value 20-year zero coupon bond issued at a yield to maturity of 10%. If you buy this bond when it

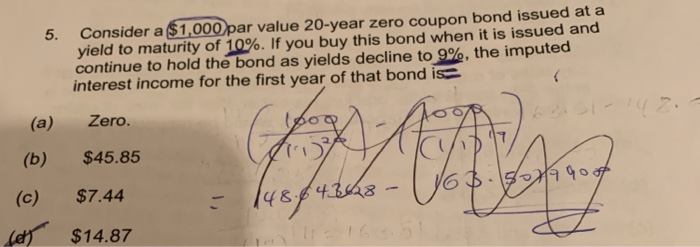

5. Consider a $1,000 par value 20-year zero coupon bond issued at a yield to maturity of 10%. If you buy this bond when it is issued and continue to hold the bond as yields decline to 9%, the imputed interest income for the first year of that bond is (a) Zero. (b) $45.85 1 (c) lett Y6B502490 $7.44 $14.87 - 148.6 4.3628

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts