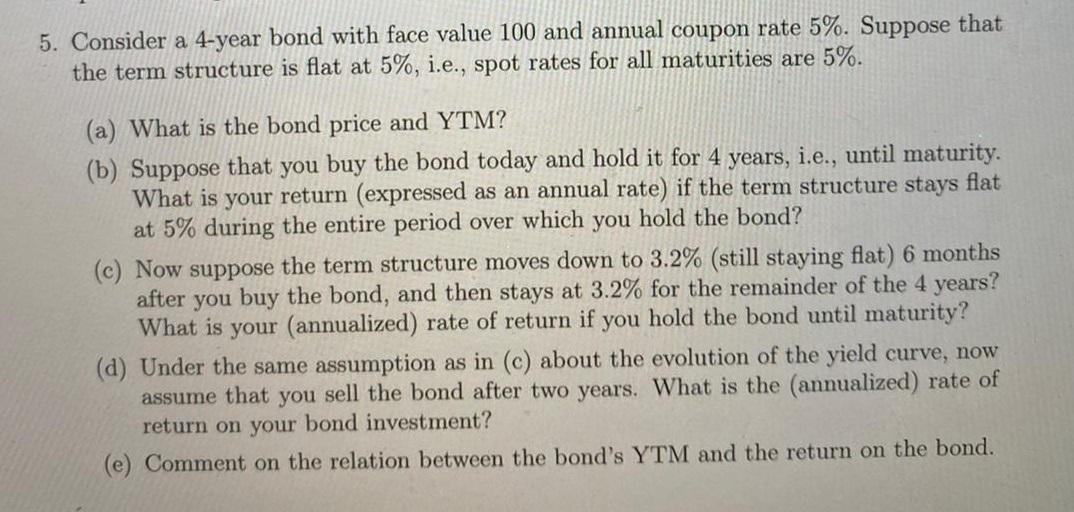

Question: 5. Consider a 4-year bond with face value 100 and annual coupon rate 5%. Suppose that the term structure is flat at 5%, i.e., spot

5. Consider a 4-year bond with face value 100 and annual coupon rate 5%. Suppose that the term structure is flat at 5%, i.e., spot rates for all maturities are 5%. (a) What is the bond price and YTM? (b) Suppose that you buy the bond today and hold it for 4 years, i.e., until maturity. What is your return (expressed as an annual rate) if the term structure stays flat at 5% during the entire period over which you hold the bond? (c) Now suppose the term structure moves down to 3.2% (still staying flat) 6 months after you buy the bond, and then stays at 3.2% for the remainder of the 4 years? What is your (annualized) rate of return if you hold the bond until maturity? (d) Under the same assumption as in (c) about the evolution of the yield curve, now assume that you sell the bond after two years. What is the (annualized) rate of return on your bond investment? (e) Comment on the relation between the bond's YTM and the return on the bond. 5. Consider a 4-year bond with face value 100 and annual coupon rate 5%. Suppose that the term structure is flat at 5%, i.e., spot rates for all maturities are 5%. (a) What is the bond price and YTM? (b) Suppose that you buy the bond today and hold it for 4 years, i.e., until maturity. What is your return (expressed as an annual rate) if the term structure stays flat at 5% during the entire period over which you hold the bond? (c) Now suppose the term structure moves down to 3.2% (still staying flat) 6 months after you buy the bond, and then stays at 3.2% for the remainder of the 4 years? What is your (annualized) rate of return if you hold the bond until maturity? (d) Under the same assumption as in (c) about the evolution of the yield curve, now assume that you sell the bond after two years. What is the (annualized) rate of return on your bond investment? (e) Comment on the relation between the bond's YTM and the return on the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts