Question: 5. Consider a three-period binomial tree model for a stock price process St under which the stock price either rises by 18% or falls by

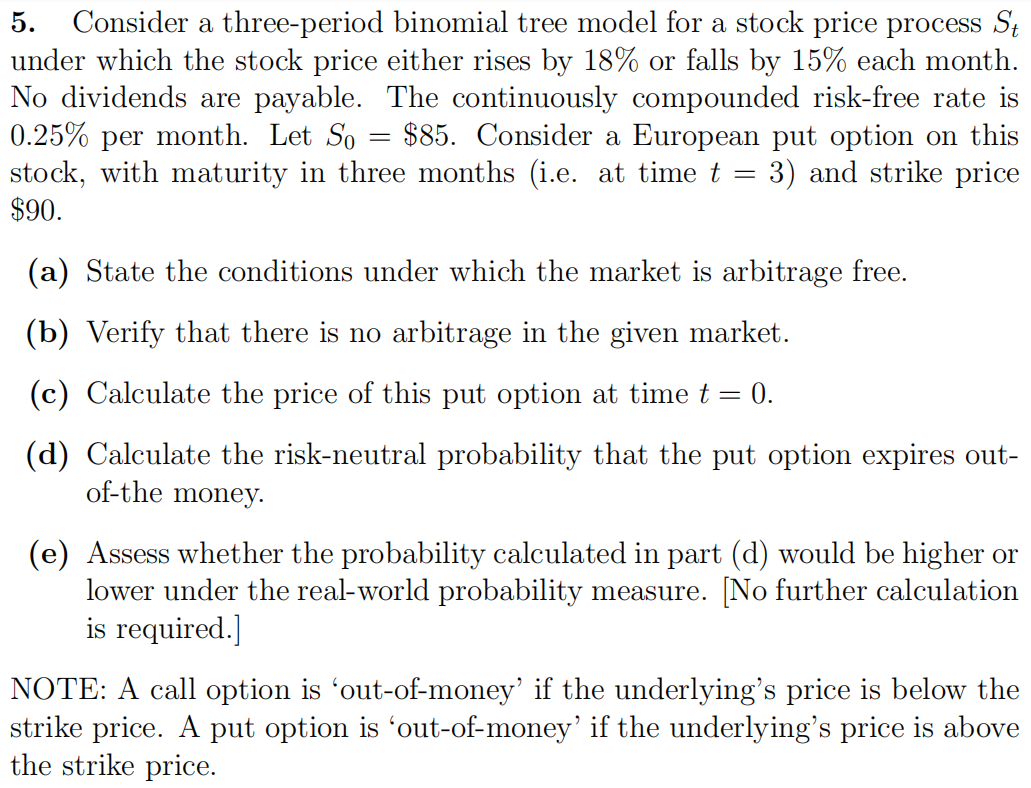

5. Consider a three-period binomial tree model for a stock price process St under which the stock price either rises by 18% or falls by 15% each month. No dividends are payable. The continuously compounded risk-free rate is 0.25% per month. Let So = $85. Consider a European put option on this stock, with maturity in three months (i.e. at time t = 3) and strike price $90. (a) State the conditions under which the market is arbitrage free. (b) Verify that there is no arbitrage in the given market. (c) Calculate the price of this put option at time t = 0. (d) Calculate the risk-neutral probability that the put option expires out- of-the money. (e) Assess whether the probability calculated in part (d) would be higher or lower under the real-world probability measure. [No further calculation is required.] NOTE: A call option is out-of-money' if the underlying's price is below the strike price. A put option is 'out-of-money' if the underlying's price is above the strike price. 5. Consider a three-period binomial tree model for a stock price process St under which the stock price either rises by 18% or falls by 15% each month. No dividends are payable. The continuously compounded risk-free rate is 0.25% per month. Let So = $85. Consider a European put option on this stock, with maturity in three months (i.e. at time t = 3) and strike price $90. (a) State the conditions under which the market is arbitrage free. (b) Verify that there is no arbitrage in the given market. (c) Calculate the price of this put option at time t = 0. (d) Calculate the risk-neutral probability that the put option expires out- of-the money. (e) Assess whether the probability calculated in part (d) would be higher or lower under the real-world probability measure. [No further calculation is required.] NOTE: A call option is out-of-money' if the underlying's price is below the strike price. A put option is 'out-of-money' if the underlying's price is above the strike price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts