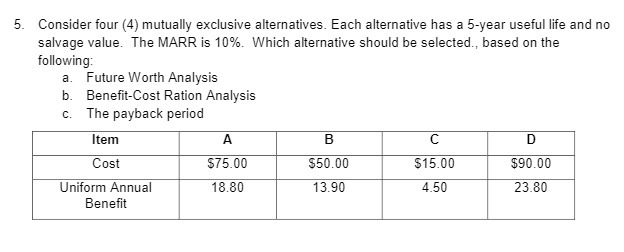

Question: 5. Consider four (4) mutually exclusive alternatives. Each alternative has a 5-year useful life and no salvage value. The MARR is 10%. Which alternative should

5. Consider four (4) mutually exclusive alternatives. Each alternative has a 5-year useful life and no salvage value. The MARR is 10%. Which alternative should be selected., based on the following: a. Future Worth Analysis b. Benefit-Cost Ration Analysis c. The payback period Item A B C D Cost $75.00 $50.00 $15.00 $90.00 Uniform Annual 18.80 13.90 4.50 23.80 Benefit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts