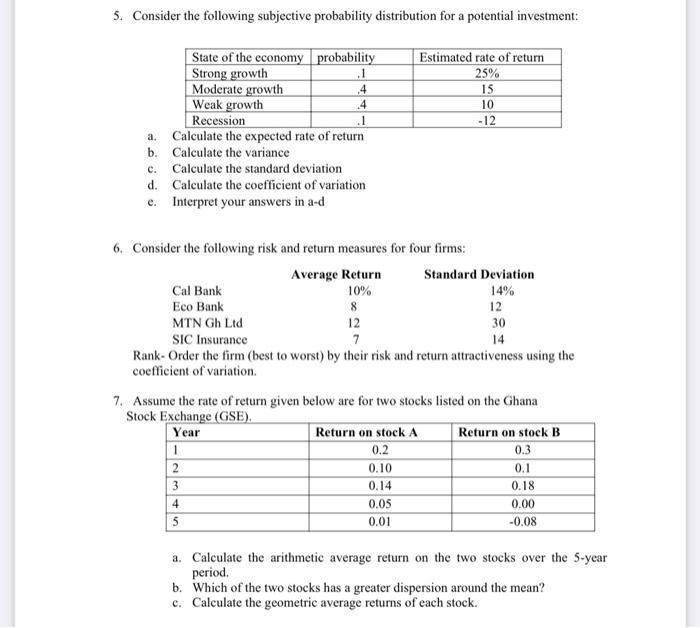

Question: 5. Consider the following subjective probability distribution for a potential investment: a. b. c. d. State of the economy probability Strong growth Moderate growth

5. Consider the following subjective probability distribution for a potential investment: a. b. c. d. State of the economy probability Strong growth Moderate growth Weak growth Recession Calculate the expected rate of return Calculate the variance e. Interpret your answers in a-d Calculate the standard deviation Calculate the coefficient of variation .1 Cal Bank Eco Bank MTN Gh Ltd 4 4 .1 6. Consider the following risk and return measures for four firms: Average Return 10% 8 12 1 2 3 4 5 Estimated rate of return 25% 15 10 -12 SIC Insurance 7 Rank- Order the firm (best to worst) by their risk and return attractiveness using the coefficient of variation. Standard Deviation 14% 12 7. Assume the rate of return given below are for two stocks listed on the Ghana Stock Exchange (GSE). Year Return on stock A 0.2 0.10 0.14 0.05 0.01 30 14 Return on stock B 0.3 0.1 0.18 0.00 -0.08 a. Calculate the arithmetic average return on the two stocks over the 5-year period. b. Which of the two stocks has a greater dispersion around the mean? c. Calculate the geometric average returns of each stock.

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

10573 answers 5a Expected rate of return SumProbabilty Estimated rate of return ans5d ie 0125041504100112 1130 The most expected return from the poten... View full answer

Get step-by-step solutions from verified subject matter experts