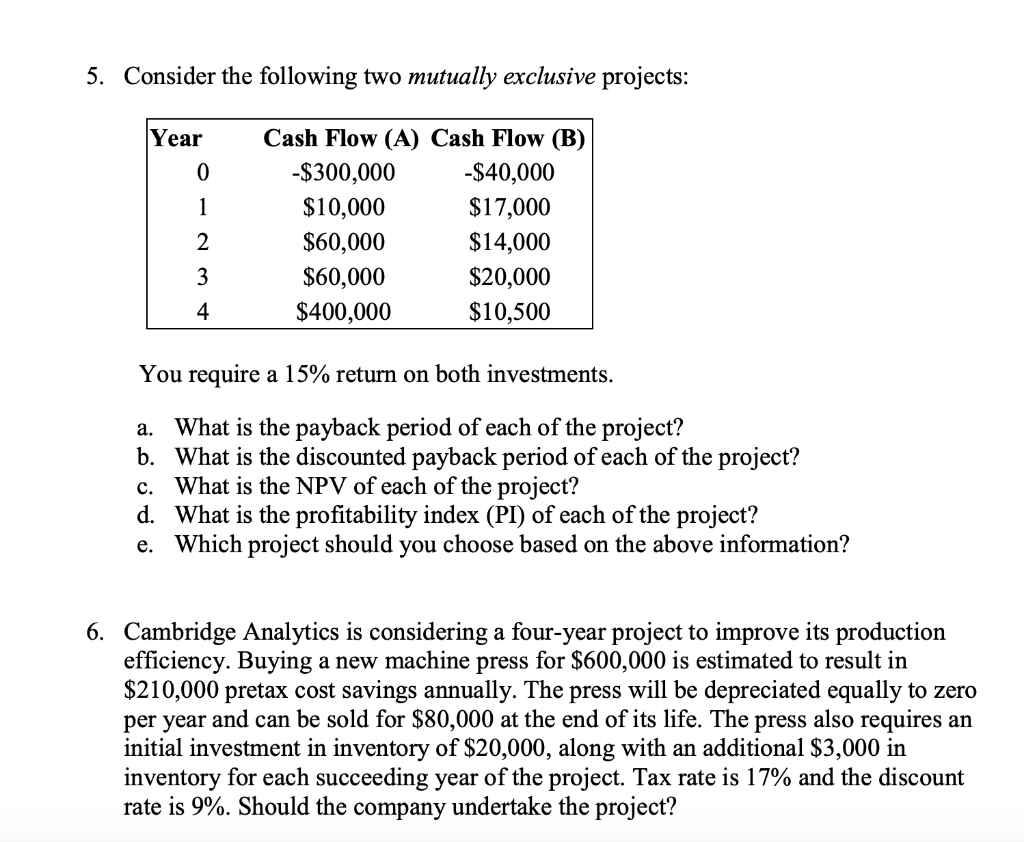

Question: 5. Consider the following two mutually exclusive projects: YearCash Flow (A) Cash Flow (B) -$300,000 $10,000 $60,000 $60,000 $400,000 0 -$40,000 $17,000 $14,000 $20,000 $10,500

5. Consider the following two mutually exclusive projects: YearCash Flow (A) Cash Flow (B) -$300,000 $10,000 $60,000 $60,000 $400,000 0 -$40,000 $17,000 $14,000 $20,000 $10,500 2 4 You require a 15% return on both investments. a. What is the payback period of each of the project? b. What is the discounted payback period of each of the project? c. What is the NPV of each of the project? d. What is the profitability index (PI) of each of the project? e. Which project should you choose based on the above information? 6. Cambridge Analytics is considering a four-year project to improve its production efficiency. Buying a new machine press for $600,000 is estimated to result in $210,000 pretax cost savings annually. The press will be depreciated equally to zero per year and can be sold for $80,000 at the end of its life. The press also requires an initial investment in inventory of $20,000, along with an additional S3,000 in inventory for each succeeding year of the project. Tax rate is 17% and the discount rate is 9%. Should the company undertake the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts