Question: Consider the following two projects: Year 0 Cash Project Flow -100 -73 A B Year 1 Year 2 Cash Cash Flow Flow 40 50

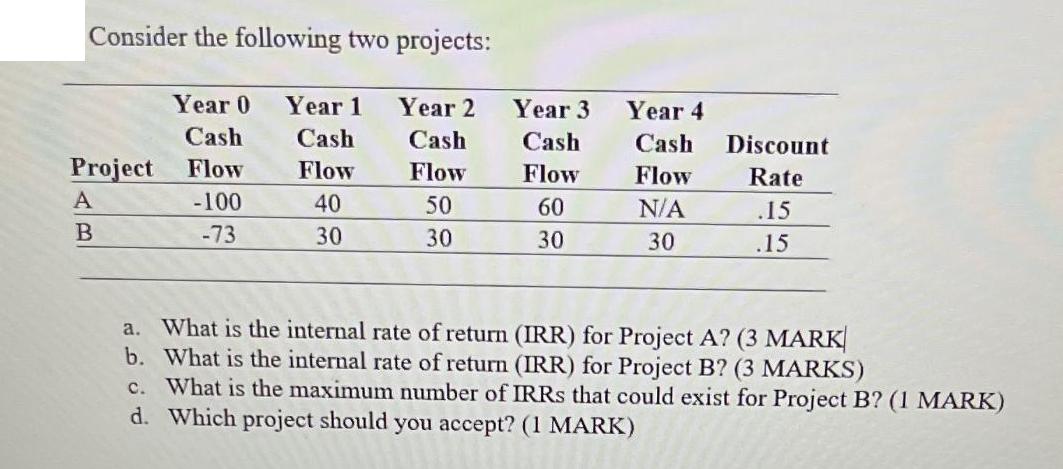

Consider the following two projects: Year 0 Cash Project Flow -100 -73 A B Year 1 Year 2 Cash Cash Flow Flow 40 50 30 30 Year 3 Cash Flow 60 30 Year 4 Cash Flow N/A 30 Discount Rate .15 .15 a. What is the internal rate of return (IRR) for Project A? (3 MARK b. What is the internal rate of return (IRR) for Project B? (3 MARKS) c. What is the maximum number of IRRs that could exist for Project B? (1 MARK) d. Which project should you accept? (1 MARK)

Step by Step Solution

3.43 Rating (169 Votes )

There are 3 Steps involved in it

a To calculate the internal rate of return IRR for Project A we need to find the discount rate that ... View full answer

Get step-by-step solutions from verified subject matter experts